Search Results

Search results for: "Habi" in All Categories

-

1 June 2023

IDB Invest invests USD15m in Habi

IDB Invest provided a USD15M structured loan to Habi, a Colombian...

-

19 April 2023

Victory Park Invests USD100m in Colombia’s Habi

Victory Park Capital provided a USD100m credit line to Colombia-based...

-

1 February 2023

BBVA Provides USD21m Credit Line to Colombia’s Habi

(LatamList) Tuhabi, a subsidiary of Colombia-based protech Habi focused on...

-

29 June 2021

SoftBank Leads USD100m Series B for Colombian Proptech Habi (en español)

SoftBank led a USD100m Series B for Habi, a Colombian middle-class...

-

15 January 2021

Alphabit, AU21 Capital, Fomocraft Ventures and Others Invest US$1.45m in Fintech Royale Finance

Crypto fund Alphabit, AU21 Capital, Fomocraft Ventures, Kyros Ventures,...

-

26 August 2020

Inspired Capital Leads US$10m Series A in Colombian Proptech Habi

Inspired Capital led a US$10m Series A in Habi, a Colombian proptech...

-

15 November 2019

Tiger Global Leads a US$5.5m Investment in Habi

Tiger Global led a US$5.5m seed investment in Habi, a Colombian proptech...

-

17 July 2019

Abu Dhabi Investment Authority (ADIA) to Invest in Latin America

Abu Dhabi Investment Authority (ADIA)’s real estate team stated that...

-

22 August 2023

2023 Startup Directory & Ecosystem Insights

LAVCA’s 2023 Startup Directory & Ecosystem Insights profiles 501...

-

16 February 2023

2023 LAVCA Trends in Tech

Access LAVCA’s 2023 LAVCA Trends in Tech, which breaks down 2022 VC...

-

17 August 2022

2022 Latin American Startup Directory

LAVCA’s seventh annual Latin American Startup Directory profiles 523...

-

22 June 2022

Vine Ventures Reaches USD140m Final Close for Seed-stage Venture Fund

Vine Ventures reached a USD140m final close for Vine Ventures II. The...

-

25 May 2022

ADIA To Provide Financing for Santa Fe-Córdoba aqueduct

ADIA agreed to finance part of the Santa Fe-Córdoba aqueduct in...

-

7 April 2022

Lanx Capital, Gávea Investimentos, Dynamo and the Moreira Salles FO Invest BRL389m in Brazil’s re.green

The family office of the Moreira Salles family, Lanx Capital, Gávea...

-

7 February 2022

2022 LAVCA Trends in Tech

Access LAVCA’s 2022 LAVCA Trends in Tech, which breaks down 2021 VC...

-

3 February 2022

Kinea Ventures and G2D Lead USD25m Series A for Brazilian E-Commerce Platform Digibee (em português)

Kinea Ventures and Brazil VC G2D led a USD25m Series A for Digibee, a...

-

2 February 2022

Glade Brook Capital Leads USD125m Series C for Chilean Insurtech Betterfly

Glade Brook Capital Partners led a USD125m Series C for Chilean insurtech...

-

6 January 2022

Generate Capital Invests BRL403m in Brazil’s Conasa

Generate Capital invested BRL403m (~USD71.4m) in Conasa Infraestructura,...

-

8 November 2021

Mubadala Acquires Brazil’s Metrô Rio and Metrô Barra

Mubadala acquired Rio de Janeiro subway operators Metrô Rio and Metrô...

-

28 October 2021

Astella Investimentos Leads ~USD5m Round for Brazilian Proptech Homelend (em português)

Astella Investimentos led a ~USD5m round for Homelend, a Brazilian real...

-

12 September 2021

Draper Cygnus Invests USD1m in Argentine Decentralized Collaboration Platform EGG (en español)

Draper Cyngus invested USD1m in EGG, an Argentine platform for...

-

25 August 2021

Iporanga Ventures Leads ~USD1.3m Seed Round for Brazilian Fintech Klavi (em português)

Iporanga Ventures led a ~USD1.3m seed round for Klavi, a Brazilian open...

-

17 August 2021

Mubadala Investment Company and Magni Partners Receive Approval by CADE to Aacquire Four Drilling Rigs from Sete Brasil (em português)

The General Superintendence of the Administrative Council for Economic...

-

10 August 2021

Canary Invests in Brazilian Accounts Receivables Financing Platform Marvin (em português)

Canary invested in Marvin, a Brazilian account receivables- based...

-

3 August 2021

GLP Reaches BRL2.6b Final Close for Brazil Development Fund

GLP reached a BRL2.6b final close for its GLP Brazil Development Partners...

-

27 July 2021

Kingsway Capital Leads USD16.3m Series A for Argentine Crypto Platform Lemon

Kingsway Capital led a USD16.3m Series A for Lemon, an Argentine crypto...

-

21 July 2021

Valor Capital Group Leads USD3.6m Round for Corporate Benefits Platform Quansa

Valor Capital Group led a USD3.6m round for Quansa, a Chile- and...

-

13 July 2021

WE Ventures Invested ~USD1.1m in Brazilian Marketing Intelligence Platform Mobees (em português)

We Ventures invested ~USD1.1m in Mobees, a Brazilian marketing...

-

8 July 2021

Susten Energia and BFL Administradora to Raise BRL50m for Solar Projects (em português)

Susten Energia and BFL Administradora announced that they have teamed up...

-

3 July 2021

Rutal al Sur is Granted to Patria's Rodovias Colombia (en español)

Rutal al Sur (Santana-Mocoa-Neiva concession) is formally granted to...

-

29 June 2021

Tiger Global Leads USD22m Series B for Brazilian Corporate Benefits Platform Flash (em português)

Tiger Global led a USD22m Series B for Flash, a Brazilian on-demand...

-

29 June 2021

Luxor Capital Leads USD14.3m Seed Round for Colombian Sales Platform Treinta (en español)

NY-based hedge fund Luxor Capital led a USD14.3m seed round for Treinta, a...

-

29 June 2021

IDB Invest, Blue Like an Orange and Mexico Ventures Lead USD27.5m Round in Mexican Lending Platform kubo.financiero (en español)

IDB Invest, Blue Like an Orange and Mexico Ventures led a USD27.5m round...

-

16 June 2021

Chilean Insurtech Betterfly Raises USD60m Series B from DST, QED, Valor, Endeavor, SoftBank (en español)

Betterfly (formerly Burn to Give), a Chilean certified B-Corp insurtech...

-

13 June 2021

Patria's Athena Saúde Acquires Hospital Alagoinhas for BRL137.1m (em português)

Patria’s Athena Saúde has acquired Brazilian Hospital das Clínicas...

-

13 May 2021

AcNext Capital Leads BRL10m Round for B4A Brazilian Influencer Marketing Platform B4A (em português)

AcNext Capital, a syndicate formed by former Accenture Latin America CEO...

-

22 April 2021

TMT Investments and Copernion Capital Partners Lead USD22m Series A for Colombian Foodtech Muncher (en español)

TMT Investments and Copernion Capital Partners led a USD22m Series A for...

-

14 April 2021

Valor Capital Group Leads USD20m Series B for Home Care Platform Beep Saúde

Valor Capital Group led a USD20m Series B for Beep Saúde, a Brazilian...

-

5 April 2021

LarrainVial and Ingevec Invest USD200m of Debt and Equity to Develop Seven Apartment Towers (en español)

LarrainVial and Ingevec will invest USD200m of debt and equity to develop...

-

26 March 2021

Mountain Nazca Leads USD2.3m Round for Mexican E-Commerce Platform Meru (en español)

Mountain Nazca led a USD2.3m preseed round for Meru, a Mexican e-commerce...

-

4 March 2021

SoftBank Invests in Brazil-based UOL EdTech (em português)

SoftBank, through its SoftBank Latin America Fund, has made an undisclosed...

-

23 February 2021

Angel Ventures and Mountain Nazca Lead USD4.2m Series A for Chilean Debt Collection Colektia (en español)

Angel Ventures and Mountain Nazca led a USD4.2m Series A for Colektia, a...

-

9 February 2021

DILA Capital Reaches US$35m First Close for DILA IV (en español)

DILA Capital reached a US$35m first close for DILA IV. IDB Lab is acting...

-

5 February 2021

Alaya Capital Partners, Potencia Ventures, Mr. Pink, and Winnipeg Invest US$600k in Talently (en español)

Alaya Capital Partners, Potencia Ventures, Mr. Pink, and Winnipeg made a...

-

4 February 2021

KPTL Leads R$6m Round in Brazilian User Experience Research Platform MindMiners (em português)

KPTL led a R$6m investment in MindMiners, a Brazilian rewards platform...

-

22 January 2021

Mubadala Acquires Control of Rota das Bandeiras for R$2b (em português)

Mubadala Investment Company has acquired Farallon Capital Management’s...

-

19 January 2021

Nexxus and IGNIA Announce Alliance (en español)

Mexican PE Nexxus Capital announced an undisclosed commitment in...

-

15 January 2021

MAYA Capital Leads R$3.5m Round in Brazilian E-commerce Platform Unbox (em português)

MAYA Capital led a R$3.5m round in Unbox, a Brazilian e-commerce platform...

-

31 December 2020

QED Investors Leads US$17.5m Series A in Chilean Insurtech Betterfly (formerly Burn to Give)

QED Investors led a US$17.5m Series A in Betterfly (formerly Burn to...

-

22 December 2020

Alere Advisors Leads US$3.3m Series A in Colombian Grocery Delivery Platform Superfüds (en español)

Alere Advisors led a US$3.3m Series A in Superfüds, a Colombian grocery...

-

17 December 2020

Mountain Nazca Leads US$17.5m Series A in Peruvian Edtech Crehana (en español)

Mountain Nazca led a US$17.5m Series A in Crehana, a Peruvian edtech, with...

-

14 December 2020

Hetz Ventures Leads US$3.55m Round in Mexican Fintech Mozper

Israel-based VC Hetz Ventures led a US$3.55m round in Mozper, a...

-

10 December 2020

Jaguar Ventures, Investo, and Liquid2 Ventures Invest US$2.3m in Chilean Justo (en español)

Jaguar Ventures, Investo, and Liquid2 Ventures invested US$2.3m in Justo,...

-

1 December 2020

monashees Leads R$28m Seres A in Brazilian Coffee Shop The Coffee (em português)

monashees led a R$28m Series A in The Coffee, a Brazilian self-serve...

-

17 November 2020

Memory Merges with Accel-KKR Backed Siigo (en español)

Software Uruguay-based company Memory has announced a merger with...

-

7 November 2020

GIC Invests R$425m in Brazilian Management Systems Company Sankhya (em português)

GIC has invested R$425m in Sankhya, a Brazil-based supplier of business...

-

3 November 2020

Astella Investimentos Leads US$1.4m Round in Brazilian HRtech BossaBox (em português)

Astella Investimentos led a US$1.4m round in BossaBox, a Brazilian...

-

19 October 2020

PortfoLion and NCRD Invest US$5.3m in Polish Ecommerce Marketing Platform edrone (em português)

Budapest-based VC fund PortfoLion and the Polish National Center for...

-

12 October 2020

Healthcare Management Startup MedPass Raises US$6m From Undisclosed Investors

MedPass, Brazilian employee healthcare management platform for SMEs,...

-

5 October 2020

SoftBank, DST Global, and Greenoaks Lead Undisclosed Round in Car Resale Kavak

SoftBank, DST Global, and Greenoaks led an undisclosed round in Kavak, a...

-

8 September 2020

ACON-Backed CryoHoldco Acquires Cordcell (en español)

ACON-backed CryoHoldco, a Mexico-based technology company,...

-

5 September 2020

Redpoint eventures Leads R$10m Series A in Brazilian Clothing Resale Marketplace Repassa (em português)

Redpoint eventures led a R$10m Series A in Repassa, a Brazilian clothing...

-

1 September 2020

Ulu Ventures Leads US$3m in Mexican Employee Management Startup Rever

Ulu Ventures led a US$3m round in Rever, a Mexican employee innovation...

-

31 August 2020

Blue like an Orange Invests R$30m in Placi

Blue like an Orange Sustainable Capital invested R$30m in Placi, a...

-

23 August 2020

Waha Capital to Invest US$50m in Argentine Traveltech Despegar.com

Waha Capital has agreed to invest US$50m in Argentina-based online travel...

-

17 August 2020

Mubadala and Magni Partners Receive Approval from CADE to Acquire Drilling Rigs (em português)

Mubadala Investment Company and Magni Partners received approval from CADE...

-

7 August 2020

DOMO Invest Makes R$5m Investment in IT Maintenance and Support Platform FindUP (em português)

DOMO Invest made a R$5m investment in FindUP, a Brazilian IT maintenance...

-

14 July 2020

Globant Ventures Makes an Undisclosed Investment in Safety Startups Woocar and Drixit

Globant Ventures made an undisclosed investment in Argentine startups...

-

30 June 2020

Mountain Nazca and Foundation Capital Lead a US$12m Bridge Round in Grocery Delivery Startup Jüsto

Mountain Nazca and Foundation Capital led a US$12m follow-on investment in...

-

3 June 2020

Valor Capital and Redpoint eventures Lead a US$47m Series B in Tembici

Tembici, a Brazilian micro-mobility platform focused on bikes, raised a...

-

31 March 2020

MIRA Fund Acquires Plot of Land in Mexico City for ~US$100m (en español)

Real assets investment fund MIRA has acquired a commercial and residential...

-

24 March 2020

Seedrs, Kinled Holding, and Lab Ventures Invest US$1.4m in Bricksave (en español)

UK-based real estate crowdfunding platform Bricksave raised a US$1.4m...

-

6 March 2020

FCC and IFM Investors Subsidiary Aquilia Acquire 13 Water Concessions in Colombia (en español)

Aqualia, water subsidiary of citizen service group FCC and Australian...

-

22 February 2020

KfW Invests US$31m in Genneia (en español)

German Development Bank KfW Invested US$31m in Genneia, an Argentine...

-

3 February 2020

Cedro Capital Invests R$2.5m in Portal de Compras Públicas (em português)

Cedro Capital invested R$2.5m in Portal de Compras Públicas, a Brazilian...

-

29 January 2020

Smart Money Ventures Leads a R$3m Investment in Gama Academy (em português)

Smart Money Ventures led a R$3m investment in Gama Academy, a Brazilian...

-

17 January 2020

Promecap Launches Third CKD for US$320m Mexican Stock Exchange (en español)

Mexico’s Promecap Capital launched its third CKD for US$320m on the...

-

15 January 2020

Banco BV invests R$25m in Personal Finance App, Olivia (em português)

banco BV (formerly Banco Votorantim) led a R$25m investment in Olivia, a...

-

31 December 2019

CITES and Others Invest US$2.7m in Biotech Eolo Pharma (en español)

Uruguay-based biotech Eolo Pharma raised a US$2.7m Series A from CITES and...

-

11 December 2019

Valar Ventures Leads a Series A US$19m in Albo

Valar Ventures led a US$19m extension to Mexican fintech Albo’s Series...

-

18 November 2019

Criatec 3 Invests R$2.5m in NeuroUp (em português)

Criatec 3, managed by Inseed Investimentos, made a R$2.5m investment in...

-

14 November 2019

Finsa to Launch its 3rd CKD on the Mexican Stock Exchange (en español)

Mexican industrial real estate developer Finsa plans to launch its third...

-

13 November 2019

Redpoint eventures Leads a US$1.12m Investment in Vittude

Redpoint eventures led a US$1.12m seed investment in Vittude, a Brazilian...

-

12 November 2019

Redwood Ventures Invests in Parco (en español)

Redwood Ventures led an undisclosed investment in Mexico-based payments...

-

17 October 2019

ALLVP and InQlab Invest ~US$2.5m in Slang (en español)

ALLVP and InQlab invested ~US$2.5m in Slang, a Boston-based edtech focused...

-

30 September 2019

Fundo BR Startups Invests R$2.5m in Árvore Educação (em português)

Fundo BR Startups, managed by MSW Capital, invested R$2.5m in Árvore...

-

16 September 2019

Credicorp, Expertia Travel, and Others Invest ~US$5m in Independencia (en español)

Independencia, a Peruvian consumer lending platform, raised ~US$5m from...

-

7 September 2019

Patricia Saenz (Mountain Nazca Colombia) and Paula Arango (Elevar Equity) Launch EWA Capital (en español)

Patricia Saenz (Mountain Nazca Colombia) and Paula Arango (Elevar Equity)...

-

5 September 2019

OPIC Invests US$400m in Argentina Toll Road

OPIC announced that its Board of Directors has voted to approve US$400m in...

-

18 July 2019

Riverstone-Backed Vista Oil & Gas Completes A Follow-On Offering via the NYSE

Vista Oil & Gas, a Mexico based energy company, raised US$107m in a...

-

16 July 2019

DOMO Invests R$4m in MLabs (em português)

DOMO Invest made a R$4m investment in MLabs, a Brazilian SaaS platform for...

-

15 July 2019

EqSeed Invests R$1.2m in Brazilian Fintech Peak Invest (em português)

Brazilian fintech Peak Invest raised R$1.2m on equity crowdfunding...

-

7 July 2019

Paladin Realty Partners To List a CERPI For MXN$4b on the BMV (en español)

Real Estate investor Paladin Realty Partners is preparing to list a CERPI...

-

24 June 2019

Puerto Rican Mobile Analytics Burea Raises US$2m from Local Investors (en español)

Burea, a Puerto Rican mobile analytics platform for offline sales, raised...

-

29 April 2019

Chromo Invest leads Series B Investment in Fitpass (en español)

Chromo Invest led an undisclosed Series B investment in Fitpass, a Mexican...

-

26 April 2019

Redwood Ventures, Angels & Family Office Invest US$1.3m in Crabi (en español)

Crabi, a Mexican auto insurance startup, raised a US$1.3m seed round led...

-

12 April 2019

BR Startups invests R$2M in Carflix (em Português)

BR Startups, managed by MSW Capital, invested R$2m in Carflix, a...

-

9 April 2019

IGNIA Partners Invests in Mexico's Takeoff

IGNIA Partners made an undisclosed investment in Takeoff, an ecommerce...

-

9 April 2019

FCP Innovación Leads US$3m Series A in Colombian Startup Leal (en español)

Leal (formerly Puntos Leal), a Colombian consumer rewards platform, raised...

-

3 April 2019

Adobe Capital & IGNIA to Exit Mexico's Provive

Adobe Capital and IGNIA announced their divestment from Provive, a Mexican...

-

2 April 2019

Linx Acquires Brazil's Hiper for R$50m (em português)

Linx will acquire Hiper for a reported R$50m, providing an exit for...

-

13 March 2019

Softbank Leads US$1.2m Investment in Colombian Hotel Chain Ayenda Rooms (en español)

SoftBank leads a US$1.2m investment in Ayenda Rooms, a Colombian hotel...

-

25 February 2019

BR Startups Invests R$1.5m in US-based Personal Finance App Olivia (em português)

BR Startups, managed by MSW Capital, made a R$1.5m investment in US-based...

-

14 February 2019

L Catterton Acquires Argentine Winery Susana Bello Wines (en español)

Private equity firm L Catterton acquired Argentina-based winery Susana...

-

7 February 2019

BR Startups to Invest R$800k in Brazilian Edtech VOA Educação (em português)

BR Startups, managed by MSW Capital, will invest up to R$800k in Brazilian...

-

30 January 2019

Mubadala & Farallon to Acquire Rota das Bandeiras, a Brazilian Road Concession, for R$1.7b (em português)

Mubadala, Abu Dhabi’s sovereign wealth fund, and Farallon Capital...

-

14 January 2019

Mountain Nazca Leads US$7.4m Series A Investment in Albo (en español)

Mountain Nazca led a US$7.4m Series A investment in Albo, a Mexican...

-

7 January 2019

Finep Startup to Invest R$30m in 30 Brazilian Startups in 2019 (em português)

Finep Startup (formerly Startup Brasil) plans to invest R$30m in 30...

-

12 December 2018

L Catterton to Acquire Cholula

Private equity firm L Catterton has announced that it has entered into a...

-

6 November 2018

Colombia Passes New Private Equity Regulation (en español)

The Colombian government has issued a new decree specific for private...

-

25 October 2018

Spectrum 28 Capital Leads US$2m Investment in Colombian Edtech Ubits (en español)

UBits, a Colombian edtech platform for corporate training, raised US$2m...

-

23 October 2018

GINgroup Launches Seed Fund to Invest MXN$2-10m in Mexican Startups (en español)

Mexican management consultant GINgroup launched a seed-stage fund called...

-

10 October 2018

Angel Ventures Leads US$1.3m Seed Investment in Mexican Rental Platform Homie

Angel Ventures led a US$1.3m seed investment in Homie, a Mexican...

-

6 October 2018

Patrimonio Autónomo Invests US$300k in FitPal (en español)

Colombian gym network FitPal raised ~US$300k from investor...

-

27 September 2018

Beyond Capital Presents a New Residential Development in Tulum (en español)

Mexican private equity fund Beyond Capital presented its new real estate...

-

27 September 2018

SíRenta Will Develop 4,000 Apartments in Bosque Real (en español)

SíRenta will develop 4,000 apartments in its Bosque Real complex in...

-

21 September 2018

Fortem Capital Raises MXN$5,000m via BIVA Instead of BMV (en español)

Fortem Capital, a subsidiary of the IPB Group real estate company, seeks...

-

21 September 2018

Scotiabank Makes Undisclosed Investment in Colombian Consumer Lending Platform Zinobe (en español)

Scotiabank made an undisclosed investment in Zinobe, a Colombian consumer...

-

20 September 2018

DILA Capital Leads Undisclosed Series A Investment in Micro-Investing Platform Dvdendo

DILA Capital led an undisclosed Series A investment in Dvdendo, a...

-

17 September 2018

EIG Manabi Acquires Shares of Classroom Investments in MLog (en español)

EIG Manabi Holdings acquired shares of Canadian investment management firm...

-

13 September 2018

GC Capital Announces First Close of MXN100m for its Second Fund (en español)

Mexican venture firm GC Capital announced a first close of MX$100m for its...

-

6 September 2018

CKDELTA Raises MX471m for Real Estate Investments via a CKD (en español)

The real estate investment fund Administradora CKDELTA raised about $MXN...

-

5 September 2018

Adobe Capital Invests in Solar Energy Company HEG via Adobe Mezzanine Fund II (en español)

Adobe Capital and ST Capital made an undisclosed investment in Mexican...

-

4 September 2018

Thor Urbana Acquires Mexican Shopping Center Marina Town Center Mall (en español)

Thor Urbana acquired the Marina Town Center mall, within the Puerto Cancun...

-

30 August 2018

Clara Capital Acquires Argentinean Medical Packaging Manufacturer Barrier Solution (en español)

Clara Capital acquired Argentinean medicinal packaging manufacturer...

-

30 August 2018

Clara Capital Fund Acquires Pharmaceutical Supply Company Barrier Solution (en español)

The Clara Capital Fund acquired Barrier Solution, an aluminium supplier...

-

22 August 2018

Dux Capital Invests MX$600k in Airline Ticket Reselling Marketplace Refly (en español)

Dux Capital invested MX$600k in Refly, a platform for reselling airline...

-

15 August 2018

Mercado Libre's MELI Fund & Others Make US$3m Investment in Fintech Increase (en español)

Mercado Libre’s MELI Fund, and Agrega Partners made a US$3m investment...

-

1 August 2018

Mind the Gap Fund Will Focus on Series A+ Investments in LatAm Startups (en español)

Mind the Gap is a new London-based fund focused on Series A+ investments...

-

23 July 2018

Grupo Pegasus Invests US$32m in El Viajero Hostels (en español)

Grupo Pegasus will inject US$35m to build the first headquarters of El...

-

27 June 2018

Sinai Ventures, Mexamerica Ventures, and Others Invest US$1.4m in Mexican Fintech Flint (en español)

Sinai Ventures, Mexamerica Ventures and others made a US$1.46m investment...

-

17 June 2018

Colombian Corporate Learning Platform Ubits Receives US$120k Investment from Y Combinator (en español)

Ubits, a Colombian corporate learning platform, will receive a US$120k...

-

15 June 2018

Cedro Capital Makes Undisclosed Investment in Brazilian Edtech Kanttum (em português)

Cedro Capital made an undisclosed investment in Kanttum, a Brazilian...

-

15 June 2018

Alsagra Ventutres, Ajba Software, and Intelectix Invest in Mexican Cloud E-commerce Platform Muventa (en español)

Alsagra Ventures, Ajba Software and Intelectix made an undisclosed...

-

24 May 2018

Visa Leads US$12.5m Investment in Fintech YellowPepper

Visa led a US$12.5m strategic investment in Latin American fintech pioneer...

-

21 May 2018

Blackrock & Ashmore Invest in Colombia's 4G Sisga Project (en español)

The National Development Bank (FDN) of Colombia closed US$197m in...

-

16 May 2018

Angel Ventures Fund Prepares Debut CKD on Mexico's BMV (en español)

Angel Ventures seeks to raise MXN$1bn from Mexican Afores for its debut...

-

7 May 2018

Alaya Capital Partners Makes Undisclosed Investment in Chilean Startup Rocketpin (en español)

Ayala Capital Partners made an undisclosed investment in Rocketpin, a...

-

3 April 2018

BlackRock to List CERPI on Mexico's BMV (en español)

BlackRock is expected to list its debut CERPI (Certificado de Proyectos de...

-

20 March 2018

Brazilian Equity Crowdfunding Platform Kria Raises R$3m

Equity crowdfunding platform Kria (formerly Broota) raised R$1.6m from...

-

19 March 2018

Criatec 3 Invests in Brazilian Edtech Startup Playmove (em português)

Criatec 3, a venture capital fund managed by Inseed Investimentos, made a...

-

15 March 2018

Mexico's Grupo Bimbo to Launch Impact Fund (en español)

Mexican multinational baking company Grupo Bimbo, in collaboration with...

-

7 March 2018

Accion & Metlife Foundation Announce Partnership to Advance Financial Inclusion in Latam

The MetLife Foundation provided US$3.9 million for Accion to leverage...

-

27 February 2018

Brazilian Edtech Startup Tamboro Receives Investment from Paulo Ferraz (em português)

Businessman Paulo Ferraz made a R$3m investment in Brazilian edtech...

-

21 February 2018

Dalus Capital Invests MXN$121m Cloud Computing Startup Xertica (en español)

Dalus Capital made a MXN$121m investment in Xertica, a cloud computing...

-

19 February 2018

Glocal, Nesst, & Others Invest US$350k in Agtech Startup Auravant (en español)

Argentine agtech accelerator Glocal, impact investor NESsT, and others...

-

4 February 2018

VCS Capital Closes MXN$150m to Invest in Entertainment Industry (en español)

VCS Capital, a new private equity firm based in Mexico, has raised...

-

2 February 2018

Bogotá-Villavicencio Road Construction Project Closes COP$1.6b in Financing (en español)

FCP 4G, a private debt fund co-managed by Credicorp Capital and SURA Asset...

-

2 February 2018

The Abraaj Group Invests in Selina (en español)

International private equity firm The Abraaj Group has made an undisclosed...

-

25 January 2018

Vertex Sells Baja California Hotel to BPBI Hotels and Stingray for US$125m (en español)

Mexican real estate investment firm Vertex Real Estate has completed the...

-

24 January 2018

MAS Equity Partners & Rocsa Colombia Acquire 100% of Inproquim (en español)

MAS Equity Partners, through its private equity fund MAS Equity Fund III,...

-

11 January 2018

Cemex Ventures Invests US$1m in Chile's Ipsum (en español)

Cemex led a US$1m investment in Ipsum, a Chilean project management...

-

28 December 2017

Riverwood and Blackstone Acquire Argentina's Metrotel (en español)

U.S. private equity firms Riverwood Capital Partners and Blackstone have...

-

21 December 2017

Northgate Plans to Invest in Mexican Pymes Following Launch of MXN$5b CKD (en español)

Northgate Capital Mexico plans to invest in a total of six to eight small...

-

13 December 2017

Macquarie to Buy Troy Energía's Stake in Mexican Hydroelectric Project (en español)

Macquarie Infrastructure Fund agreed to purchase Troy Energía’s 51%...

-

12 December 2017

TPG's The Rise Fund & U2's Bono Invest in Argentina's Digital House (en español)

TPG’s The Rise Fund made its inaugural investment in Latin America...

-

29 November 2017

The Abraaj Group to Construct Natural Gas Platform in Mexico (en español)

The Abraaj Group has made its debut investment in Mexico’s energy sector...

-

27 November 2017

Riverstone Raises Fund to Invest in Renewable Energy in Mexico (en español)

Global private equity firm Riverstone has launched an MXN$8b CKD on the...

-

26 October 2017

LarrianVial and Colliers Partner Set to Launch New Real Estate Fund (en español)

LarrainVial and Colliers are readying to raise up to US$160m in...

-

25 October 2017

Chile's Superintendencia de Pensiones Officially Approves New AFP Regulation (en español)

The Chilean Superintendencia de Pensiones has officially approved new...

-

19 October 2017

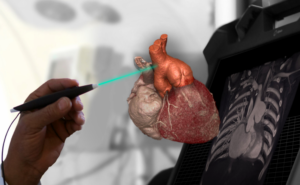

Intel Capital Leads US$8.5m Series A Round in EchoPixel

Intel Capital led a US$8.5m Series A investment in EchoPixel, a...

-

16 October 2017

InQlab and IKON Banca de Inversión Invest US$1.2m in Colombia's Mesfix (en español)

InQlab and IKON Banca de Inversión made a US$1.2m investment in Mesfix, a...

-

16 October 2017

IFM Acquires OHL Concesiones for €2.775b (en español)

Spanish construction company OHL has announced an agreement to sell its...

-

26 September 2017

EFM Capital Announces New Addition to its Portfolio (en español)

EFM Capital acquired 100% of Garyr S.A. de C.V., a Mexican company...

-

15 September 2017

HSBC México & IGNIA Partner to Launch Latin American Fintech Startupbootcamp (en español)

HSBC México and IGNIA have partnered to launch Startupbootcamp Fintech to...

-

29 August 2017

MIRA Constructs One of the Largest Mixed-Use Real Estate Projects in Nuevo Polanco (en español)

Investment and real estate platform MIRA is constructing a new mixed-use...

-

22 August 2017

Canary and Yellow Ventures Invest R$1.5m in HRtech Startup Gupy (em português)

Canary and Yellow Ventures invested R$1.5m in Gupy, an HR platform...

-

16 August 2017

Artha Capital Invests MXN$1b in Veracruz Real Estate Project (en español)

Artha Capital will invest MXN$1b in Villa del Mar, a corporate and...

-

2 August 2017

500 Startups to Invest in US$1.3m in Latin American Startups (en español)

With its eyes set on Latin America, 500 startups plans to invest US$1.3m...

-

24 July 2017

Ideas & Capital Invests Pre-Series A in Dvdendo (en español)

Ideas & Capital led a US$1.5m pre-Series A investment in Dvdendo, a...

-

13 July 2017

Parallel18 Ventures Invests in BrandsOf, Timokids and Be Better Hotels to Expand Throughout Puerto Rico (en español)

Puerto Rico accelerator Parallel18 invested US$75k each (US$225k total) in...

-

30 June 2017

Sancor Seguros to Invest ARS$750m in Fund for Entrepreneurship (en español)

Sancor Seguros will invest ARS$750m in a fund for entrepreneurship and the...

-

21 June 2017

Gava Capital Raises MXN$2.1b Through CKD for Real Estate Projects (en español)

Gava Capital has raised MXN$2.1b through the issuance of its first CKD on...

-

5 June 2017

Syndicates Invest in Chile's Keteka, Faro.travel, Monitor & PlieQ (en español)

A group of investors co-invested seed capital in Latin American startups...

-

18 May 2017

Omidyar and MDIF to Invest R$4m in Brazilian Civic Engagement App Colab.re (em português)

Omidyar and MDIF will invest R$4m in Colab.re, a Brazilian civic...

-

12 May 2017

TC Latin America Partners and Grupo Caral Present Third Real Estate Project (en español)

Private real estate fund manager TC Latin America Partners and Peruvian...

-

9 May 2017

Victoria Capital Partners Acquires Stake in Delta (em português)

Victoria Capital has acquired an 85% stake in Brazilian pharmaceutical...

-

5 May 2017

Walton Purchases Hotel Project in Nayarit, Mexico (en español)

Private equity firm Walton Street Equity completed the purchase of a hotel...

-

4 May 2017

AFPs Request to Increase Limit on Alternative Investments Outside of Peru

Two years after the Central Reserve Bank of Peru approved an increase to...

-

30 April 2017

LGT Impact Ventures Invests in General Water SA

LGT Impact Ventures has invested approximately US$21m in General Water SA,...

-

6 April 2017

Ley de FinTech in the Works as FinTech Hurricane Hits Mexico (en español)

Mexico is in the process of passing Ley de FinTech to regulate the sector,...

-

5 April 2017

Artha Capital to Launch MXN$6b CKD Vehicle for Real Estate Projects (en español)

Mexican alternative investment firm Artha Capital will issue a new CKD...

-

2 April 2017

Real Estate Funds in Mexico Move Forward with Development and Expect Higher Returns (en español)

After a brief pause following the U.S. election, private real estate funds...

-

30 March 2017

Five Keys to Understanding Argentina's Entrepreneurship Law (en español)

Four years in the making, the Argentinian Senate approved the...

-

29 March 2017

DOMO Raises R$100m from Brazilian Family Offices to Invest in Startups (em português)

DOMO Invest, a venture capital fund launched by Buscapé Co-Founder...

-

24 March 2017

Vox Capital Invests R$4m in Rio de Janeiro Education Startup (em português)

Vox Capital, one of the first impact investors in Brazil that finances...

-

22 March 2017

Balam Fund to Move Foward with Plans to Invest in Mexican Renewable Energy (en español)

Following the launch of its CKD in 2016, Balam Fund is moving forward with...

-

22 March 2017

Energy Giant Riverstone Holdings Sets Sights on Mexico (en español)

Energy-focused private equity firm Riverstone Holdings is in talks with...

-

15 March 2017

INICIA and NXTP Labs Invest US$4.3m in Argentina's VU Security (en español)

Existing investors INICIA and NXTP Labs co-invested US$4.3m in...

-

13 March 2017

Two Mexican Youth Win Opciona and Telefonica Open Future_'s Premio Innovación Anticorrupción (en español)

Two mexican youth won Telefonica Open Future_ and Opciona’s...

-

13 March 2017

Castlelake Acquires Stake in Pampa Energía's Greenwind (en español)

Argentinian investment firm Pampa Energía sold 50% of is stake in Buenos...

-

3 March 2017

GLL Latam Miracorp Buys Miracorp Corporate Center for US$47m (en español)

GLL Latam Miracorp, a subsidiary of GLL Real Estate Partners, purchased...

-

17 February 2017

Y Combinator Invests in Colombian Home and Office Services Startup Hogaru (en español)

Y combinator invested US$120k in Hogaru, a Colombian home and office...

-

15 February 2017

Sustainable Seafood Company Invests in Chile's Geomar

Zoma Capital and Encourage Capital announced the launch of the first-ever...

-

3 February 2017

Wayra Chile Invests US$400k in Chilean Digital Startups (en español)

Wayra Chile, Telefónica Open Future_’s digital business...

-

13 January 2017

Carao Ventures Invests US$550k Seed Round in GoPato (en español)

Carao Ventures led a US$550k investment in Costa Rican task services...

-

19 December 2016

Alsis Funds to Invest in Mexican Housing (en español)

Miami based private capital firm Alsis has committed to investing in the...

-

16 December 2016

LIV Capital Makes Third Investment in Mexico's Ánima Estudios (en español)

(Sentido Común) LIV Capital’s Latin Idea México Venture Capital...

-

11 December 2016

Gava to Finance Mexico's Real Estate Sector (en español)

Gava is seeking to raise up to MXN4b, via the issuance of a CKD on the...

-

7 December 2016

Mountain Nazca Leads US$3m Investment in Kavak (en español)

(Expansión) Latin American venture capital fund Mountain Nazca has led a...

-

23 November 2016

IGNIA Leads Investment Round in Mexico's Sr. Pago (en español)

(Press Release) IGNIA has invested an undisclosed amount in Mexico-based...

-

24 October 2016

New VC Funds to Propel Chilean Ecosystem (en español)

(Diario Financiero) NXTP Labs, RaiCap, Corfo, Endurance Investments, Chile...

-

21 October 2016

Southern Cross to Buy a 55% Stake in Masvida for US$90m (en español)

(Diario Financiero) Southern Cross has reached an agreement to purchase a...

-

19 October 2016

Recorrido.cl Receives US$600k (en español)

(Pulso Social) Mountain Nazca joins local and German investors in a...

-

19 October 2016

IFC Invests US$3m in NXTP Labs

(TechCrunch) The International Finance Corporation (IFC), has invested...

-

17 October 2016

Activa, LarrainVial's PE Investment Arm, Acquires FenVentures (en español)

(El Mercurio) Activa, the private equity investment arm of LarrainVial,...

-

17 October 2016

A Look into Chile’s Innovative Startup Government

(TechCrunch) The rise of “Chilecon Valley” — as the nascent startup...

-

11 October 2016

Primatec Invests in Brazilian Startup Myleus Biotecnologia (em português)

(Startupi) Primatec has closed investment negotiations with the Brazilian...

-

5 October 2016

Trident Cybersecurity, Adara Ventures & Telefónica Open Future_ Invest US$14m in 4iQ (en español)

(Expansión) Cyber Intelligence company 4iQ closed a financing round of...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...

-

23 September 2016

Leiturinha Receives R$3m from Movile (em português)

(Exame) Brazilian corporate venture investor Movile has invested R$3m...

-

2 September 2016

IATAI Enterprises Picks Up US$5m

(PEHUB) IATAI Enterprises, a financial and insurance tech company in Latin...

-

29 August 2016

Chilean Startup SimpliRoute Closes US$500k Investment (en español)

(PulsoSocial) Soluciones Orión and Wayra Chile, Grupo...

-

2 August 2016

Finep Invests R$15m in BrPhotonics (em português)

Finep invested R$15m in BrPhotonics, a Brazilian provider of high-speed...

-

27 July 2016

Andreessen Horowitz, Sequoia, DST Global Invest in Colombian App Rappi (en español)

Andreessen Horowitz invested an undisclosed amount in Rappi, a Colombian...

-

1 July 2016

New Argentinian Decree to Trigger Foreign Investments in Agriculture

(<...

-

27 June 2016

Odebrecht Sells 57% Stake in Rutas de Lima to Brookfield and Sigma Safi for Up to R$1.5b (en español)

(SEMANAeconómica) Brookfield has acquired a 57% stake and Sigma Safi an...

-

19 May 2016

Capital Invent & ON Ventures Invest US$800k in TiZKKA (en español)

(Dinero en Imagen) Capital Invent, ON Ventures, and a group of Mexican...

-

11 May 2016

IFC Invests R$60m in Brazil Fintech Startup GuiaBolso (em português)

(Link-Estadão) Brazilian fintech startup GuiaBolso has received a R$60m...

-

11 May 2016

South Ventures Makes Follow-On Investment in Trocafone (en español)

(IG Angels) Brazilian e-commerce startup Trocafone has received a...

-

11 May 2016

GP Investments Closes Bid in BR Properties (em português)

(Isto e Dinheiro) GP Investments has successfully completed its takeover...

-

1 April 2016

Sigma Safi Acquires Two Wind farms in Peru (en español)

(Sigma) Sigma Safi has acquired a 49% stake in the Peruvian wind...

-

10 March 2016

GP Investimentos Signs Deal to Secure Funding for BR Properties Bid

(Reuters) GP Investments Ltd , Latin America’s largest private...

-

10 March 2016

DILA Capital Invest in Mexico's Carolo & Le Macaron Boutique

(AMEXCAP) DILA Capital closed an investment in gourmet fusion restaurant...

-

10 February 2016

Macquarie Mexico Completes Acquisition of Industrial Properties (en español)

(Press Release) Macquarie Mexico acquired 10 industrial properties located...

-

25 January 2016

Colombian Startup Receives Investment Capital from Tim Draper (en español)

(PulsoSocial) After winning hte 2015 MassChallenge-the biggest accelerator...

-

13 January 2016

Javer Achieves the First IPO for 2016 in Latin America (en español)

(Centro Urbano) Mexican homebuilder Javer has made its IPO, raising...

-

13 January 2016

Brookfield Buys 56.7% of Isagen for US$2b (en español)

(Dinero) Canadian fund Brookfield became Isagen’s newest stakeholder...

-

12 January 2016

Jaguar Growth Partners Names Ian Wilkin as CFO and COO

(PR Newswire) Jaguar Growth Partners, a real estate private equity firm...

-

11 January 2016

Alta Ventures Raises Fund for US$200m (en español)

(El Economista) Venture capital fund Alta Ventures Mexico plans to raise a...

-

30 December 2015

Actis Exits Guatemalan Energy Provider Energuate

(PRNewswire) Actis has reached an agreement to sell Guatemalan electricity...

-

28 December 2015

Despegar.com to Land on Wall Street in 2016 (en español)

(La Nacion) Online travel agency Despegar.com, which is backed by Tiger...

-

18 December 2015

Sigma SAFI's Chilena Colbún Acquires Peru's Fenix Power

(Gestión) An investor consortium composed of Chilean utility company...

-

1 December 2015

Gaia Design, Online Platform for Buying Design Furniture at Affordable Prices Receives US$2.5m Round led by Capital Invent and Rise Capital (en español)

(Press Release) Gaia Design is an online furniture and home accessory...

-

25 October 2015

Ignia Targets US$100m for Second Fund

(El Economista) 8 years after raising its first investment fund for...

-

19 October 2015

US$1.18m Raised by Private Equity Funds in Colombia (en español)

(El Economista) The private equity industry has reached its 10 year mark...

-

17 September 2015

Mexico-based Avalancha Ventures designs ABACO and invests in Salud Cercana

(Forbes) New Mexican VC firm Avalancha Ventures has invested in Salud...

-

24 August 2015

Loggi Receives Investment of R$50m (em português)

(Fusões & Aquisições) Loggi, the online express delivery services,...

-

24 July 2015

Discovery Americas Invests MX$34m in Mexican Transportation Fund (en español)

(T21MX) Investment fund, Discovery Americas, through the vehicle DATCK 14,...

-

25 May 2015

ALLVP Invests in FormaFina to Expand Reach to Mexico

(Press Release) FormaFina is a cross-border curated marketplace for...

-

19 May 2015

Unifin to End IPO Drought (en español)

(El Financiero) Unifin Financiera, a financial services company on Mexico,...

-

27 April 2015

Colombian Startup Viajala Closes Financing Round to Grow in Mexico (en español)

(PulsoSocial) Viajala, the Medellín-based search engine for hotels and...

-

30 March 2015

Colombia's Playvox Receives US$1.5m from FCP Innnovación (en español)

(El Espectador) PlayVox, a Colombian firm that designed software used in...

-

27 February 2015

Ignia Aims to Raise MXN$2.6b through a CKD (en español)

(Ventura MX) Investment firm Ignia is planning to raise MXN$2.6b from the...

-

28 January 2015

English Firm Novator Buys Nextel Chile (en español)

(Pulso) The multinational London based firm Novator has acquired Nextel...

-

28 January 2015

Cuponeria Receives Investment of R$800m from Verus Group and Plans Expansion for 2015

(E-commerce) Cuponeria, Brazil’s online coupon and discount portal...

-

19 December 2014

Bessemer Ventures Leads R$18m Investment in Enjoei (em português)

(Valor Economico) Bessemer Ventures has lead an R$18m investment round in...

-

3 December 2014

South Ventures Invests in Colombia's Formafina (en español)

(South Ventures) South Ventures participated in Formafina’s new...

-

2 December 2014

Criatec Fund 2 Invests in Dot Legend, Creator of BoaLista and Belezuca (em português)

(Startupi) The fund Criatec II invested R$2.5m in Dot Legend. The...

-

12 November 2014

South Ventures Invests In Brazil's Trocafone.com

(South Ventures) South Ventures invested part of SV Global Fund II into...

-

3 November 2014

Chile's City Global Aims to Raise a US$10m Fund to Invest in LatAm Businesses

(Pulso Social) Chilean CEO’s Raul Ciudad and Marco Rivas aim to...

-

15 October 2014

AlaMaula Founder Invests in South Ventures

(South Ventures) The Founder of AlaMaula invested in South Venture’s...

-

15 October 2014

Axon Partners Group Expands Background Amerigo Ventures to Peru and Mexico and Extends Up to US$100m (en español)

(Pulso Social) Axon Partners Group’s investment division is expanding...

-

1 October 2014

Patria Investimentos Plans Investments of up to US$500m in Colombia (en español)

(America Economia) Patria Investmentos, one of the biggest funds in Latin...

-

9 September 2014

Grupo LOA, Linked to LarrainVial, Makes First investment of its Private Equity Fund FIP Cluster Minero (en español)

(Press Release) Grupo LOA, linked to LarrainVial, through its private...

-

6 September 2014

Patria Exits Junior Alimentos (em português)

(Exame) Patria Investimentos sold its stake in Junior Alimentos, a...

-

3 September 2014

Avenida! Receives US$17.5m to Strengthen its Platform in Argentina (en español)

(PulsoSocial) Despite being headquartered in an Argentina mired by a...

-

26 June 2014

Online Food Delivery Moves in LatAm: Delivery Hero Acquires PedidosYa (en español)

(Pulso Social) Uruguayan PedidosYa, previous portfolio company of Kasek...

-

3 April 2014

Carrot Receives US$2m Investment from Venture Partners Mexico

(Press Release) Venture Partners Mexico led successfully the Series B...

-

20 February 2014

Vontrip Closes New Round for US$500 and Begins Operations in Mexico (en español)

(Pulso Social) Having received its first investment from 500startups (and...

-

30 October 2013

Owner of Azul Launches Security Company and Invests R$100m

(Valor) The president of Azul Linhas Aéreas, David Neeleman, announced...

-

23 September 2013

BBVA Ventures Goes Fishing for Investment Opportunities in LatAm

(Pulso Social) BBVA Ventures is scoping out Latin America – starting...

-

10 September 2013

Gávea is Launching a US$200m Real Estate Fund

(Exame) Gávea Investimentos will launch a US$200 million fund to invest...

-

24 July 2013

With Additional US$10 Million from Rocket Internet, Easy Taxi Goes Global

(Pulso Social) Easy Taxi, announced a $10 million round of funding and...

-

9 July 2013

MercadoLibre Announces First Three Investments in Startups for a Total of US$300,000 (en español)

(Pulso Social) A few months ago, MercadoLibre and Wayra announced their...

-

3 July 2013

GP Investments Announces Acquisition of Beleza Natural

(Press Release) GP Investments, a leading alternative investment firm in...

-

22 May 2013

Educational start-up Eduk Raises Series A Funding from Monashees Capital (em português)

(Startupi) EDUK a teaching platform focused on professional courses, is...

-

3 May 2013

You can now Create a Company in one day in Chile (en español)

(Pulso Social) Tu empresa en un día allows you to create a company in...

-

22 February 2013

Newgrowth Fund Invests in Grupo Educativo Cead (en español)

(AMEXCAP) Mexican-based Newgrowth Fund makes an investment in Grupo...

-

17 December 2012

Aurus acquires office building assets from Union Investment (en español)

(Economia y Negocios) December 14, 2012 – Aurus acquires office...

-

24 September 2012

CoreCo Holdings and IFC raise US$53.5 Million to finance Central American Businesses (en español)

(Summa) September 24, 2012 – After closing a PE fund in the United...

-

12 March 2012

Nexus Capital and Alusa agree to purchase Colombian company for US$ 35M (en español)

(La Tercera) March 12, 2012 – The Chilean company Alusa S.A., a...

-

30 November 2010

Alothon Leads Acquisition of Casadoce

(Alothon) November 30, 2010 – Alothon Group announced the...