Deal Cases

Responsible investment, or investment practices and strategies that consider environmental and societal outcomes, has become an important area of focus for Latin America’s private capital industry. LAVCA’s work in this area addresses both Environmental, Social and Governance practices by traditional private capital investors (ESG), as well as impact funds that seek a balance of positive social, environmental, and financial returns. Global LPs are an important driver of change and are key partners to LAVCA’s Responsible Investment agenda.

-

Lightrock | dr.consulta

In December 2017, Lightrock invested in dr.consulta, a Brazil-based clinic chain that...

Read more -

Elevar Equity | TICMAS

In June 2018, Elevar Equity invested in TICMAS, an education platform with operations in...

Read more -

Vinci Partners | Pro Infusion

In November 2020, Vinci Partners invested in Pro Infusion, a Brazil-based outsourcing...

Read more -

L Catterton | NotCo

In August 2020, L Catterton invested in NotCo, a Chile-based foodtech company that...

Read more -

IG4 Capital | Iguá

In July 2017, IG4 Capital invested in Iguá Saneamento, a Brazil-based manager and...

Read more -

BTG Pactual | Gran Cursos Online

Following its investment by BTG Pactual in June 2021, Gran Cursos has been focused on...

Read more -

Ashmore | Elecnorte

Ashmore’s involvement in the Electrical Reinforcement of La Guajira 110Kv concession in...

Read more -

Mercado Libre & DILA Capital | Elenas

In June 2022, DILA Capital led a USD20m Series B for Elenas, a social commerce platform...

Read more -

ALIVE Ventures | Symplifica

OPPORTUNITY Approximately 20 million people in Latin America are engaged in paid domestic...

Read more -

Valor Capital Group | Dolado

Member Investor: Crescera Capital Company: Grupo Zelo Industry-Sector: Consumer...

Read more -

Crescera Capital | Grupo Zelo

Member Investor: Crescera Capital Company: Grupo Zelo Industry-Sector: Consumer...

Read more -

Dalus Capital | Algramo

Member Investor: Dalus Capital Company: Algramo Industry-Sector: Cleantech, Smart...

Read more -

Aqua Capital | Biotrop

Member Investor: Aqua Capital Company: Biotrop Industry-Sector: Agribusiness READ the...

Read more -

Linzor Capital Partners | Mundo

Member Investor: Linzor Capital Partners Company: Mundo Industry-Sector:...

Read more -

Lightrock | General Water

Member Investor: Lightrock Company: General Water Industry-Sector: Water and...

Read more -

Actis | Atlas Renewable Energy: Part of the Same Energy

Member Investor: Actis Company: Atlas Renewable Energy Industry-Sector: Renewable...

Read more -

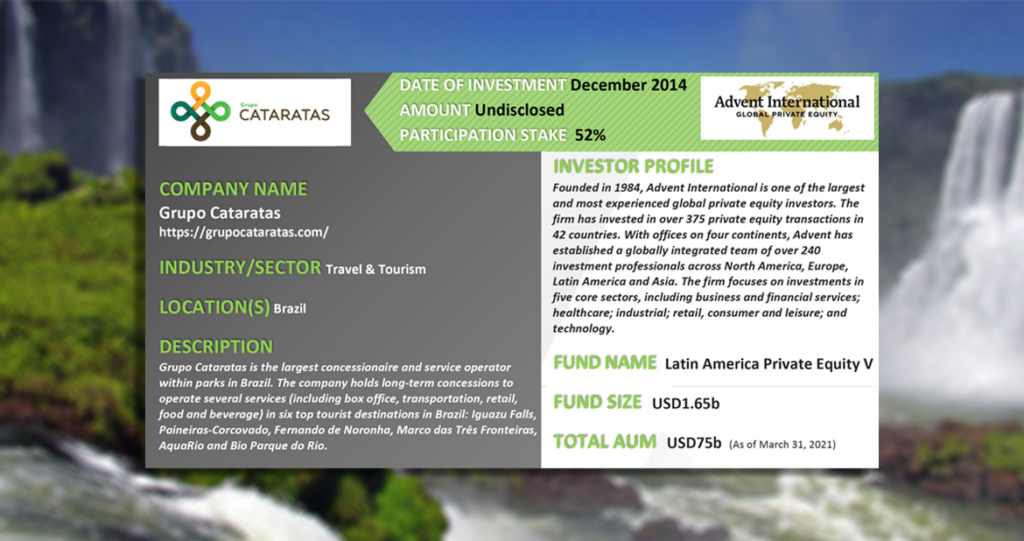

Advent International | Grupo Cataratas: Protecting Biodiversity

Member Investor: Advent International Company: Grupo Cataratas Industry-Sector: Travel...

Read more -

Mesoamerica | Alquería: A Partnership with Purpose

Member Investor: Mesoamerica Company: Alquería Industry-Sector: Agribusiness /...

Read more -

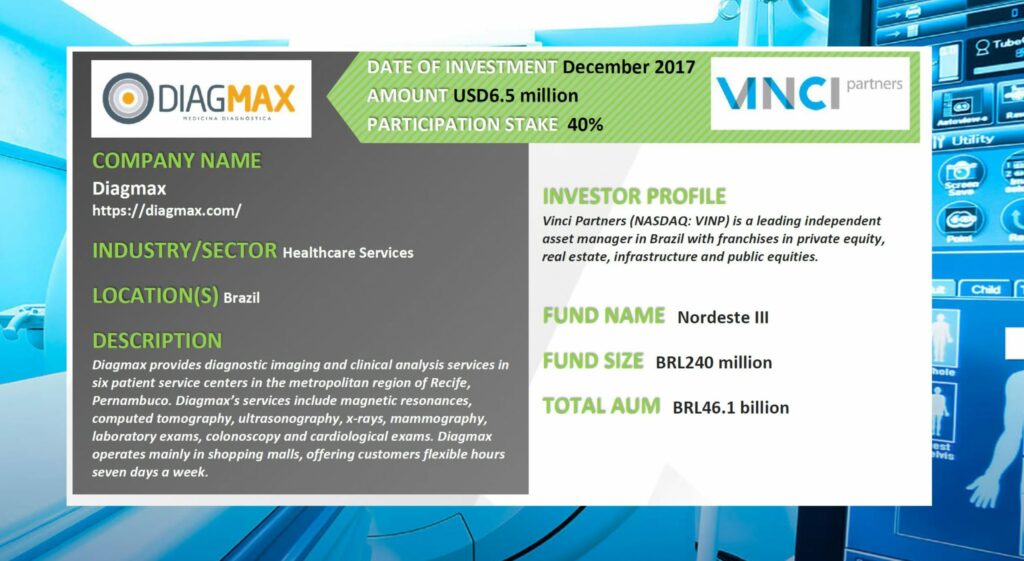

Vinci | Diagmax: A Strategic Sale

Deal Case Highlight Vinci | Diagmax: A Strategic Sale Member Investor: Vinci Company:...

Read more -

Canary | Alicerce: A Bridge to Education

Deal Case Highlight Canary | Alicerce Educação: A Bridge to Education Member Investor:...

Read more -

PC Capital | Rancho Los Molinos: An Opportunity to Flourish

Deal Case Highlight PC Capital | Rancho Los Molinos: An Opportunity to Flourish Member...

Read more -

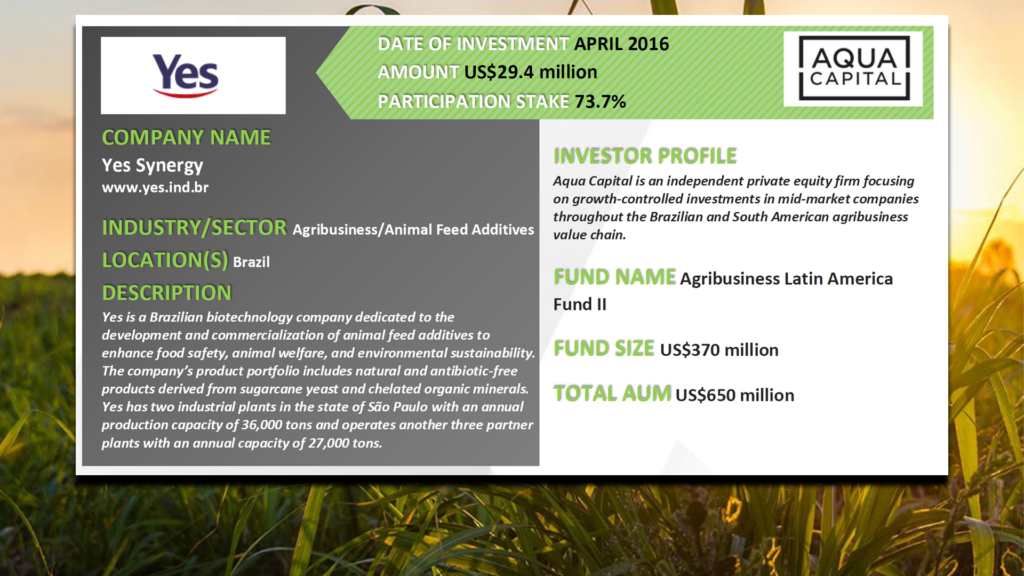

Aqua Capital | Yes Synergy: Sustainable Animal Nutrition

Deal Case Highlight Aqua Capital | Yes Synergy: Biotech/Agribusiness, Sustainable Animal...

Read more -

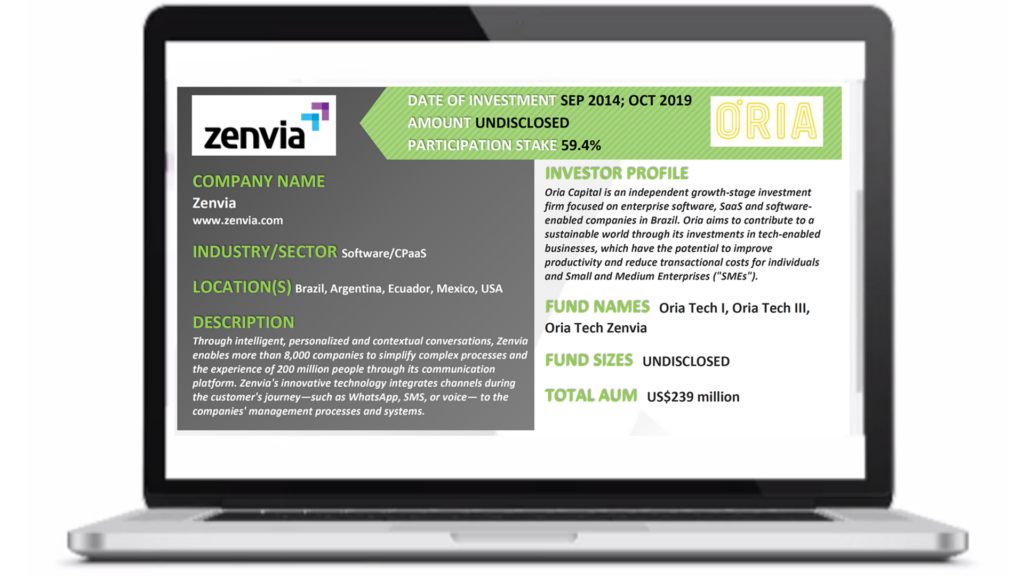

Oria | Zenvia: CPaaS Growth Amidst Pandemic

Stemming from the first six editions of the LAVCA Deal Book and ESG Cases, it is now more...

Read more -

Sixth Edition: The Latin American Private Equity Deal Book & ESG Cases

This edition features 12 cases across sectors and stages and includes deals from Brazil,...

Read more -

Fifth Edition: The Latin American Private Equity Deal Book & ESG Cases

Investments range across various stages, countries, and sectors including consumer...

Read more -

Fourth Edition: The Latin American Private Equity Deal Book & ESG Cases

Investments range across various stages, countries, and sectors including consumer...

Read more -

Third Edition: The Latin American Private Equity Deal Book & ESG Cases

Investments range across stages, countries, and sectors including consumer/retail,...

Read more -

Second Edition: The Latin American Private Equity Deal Book & ESG Cases

Investments range across stages, countries, and sectors including, energy, education,...

Read more -

First Edition: The Latin American Private Equity Deal Book & ESG Cases

Investments range across stages, countries, and sectors including, financial services,...

Read more