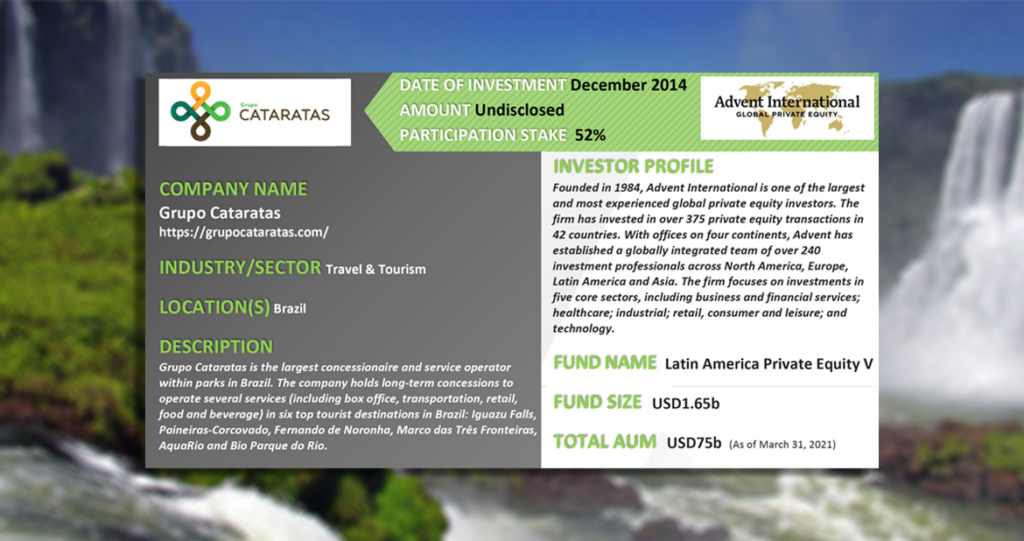

Member Investor: Advent International

Company: Grupo Cataratas

Industry-Sector: Travel & Tourism

READ the latest deal case featuring Advent International‘s investment in the largest concessionaire and service operator within parks in Brazil, Grupo Cataratas.

OPPORTUNITY

Brazilian national parks often compete for government expenditures alongside healthcare, education and other essential services, resulting in inadequate funding during tight fiscal cycles. As an alternative to public management, the Brazilian government has increasingly turned to public-private partnerships to guarantee the parks’ biodiversity conservation, maintenance and infrastructure enhancement through programs of visitation and environmental education. Concessions often present an attractive investment opportunity for private investors. A concession provides the winning bidder a contracted right to operate a park for 15-20 years in exchange for guaranteed follow-on investments and specific commitments to environmental conservation.

EXECUTION

Advent acquired a 50% stake in Cataratas in 2014 with a value proposition that was focused on improving services offered in parks where Cataratas already operated, followed by expansion into additional parks throughout Brazil. A holding company with a senior management team and relevant committees was created to consolidate the leadership of multiple local concessionaires. This centralized structure allowed for long-term growth planning, strengthened cross-selling initiatives, increased cost efficiencies and facilitated coordinated conservation efforts. As a result, Cataratas saw a revenue CAGR of 23% between 2014 and 2019.

ESG IN FOCUS

Following Advent’s investment, Cataratas started publishing annual sustainability reports with guidelines from the Global Reporting Initiative. In 2016, the company created the Conhecer para Conservar institute to promote environmental education, conservation and ecosystem restoration through partnerships with public entities, private organizations and leading experts in the field.

Cataratas has invested over BRL30m (~USD5.8m) in research and development efforts for the recovery and conservation of biodiversity in protected areas. At the end of 2020, the company had 26 ongoing research initiatives, which included projects aimed at understanding the reproduction patterns of threatened species to inform their reintroduction into the wild. In addition, the company implemented a social and environmental management tool called SistemaECO to track various eco-efficiency indicators, including use of water, energy efficiency, animal well-being, solid and liquid waste, safety, stakeholder relationships and community engagement.

RESPONSE TO COVID-19

While parks had to close temporarily or operate at limited capacity due to Covid-19, Cataratas organized a fundraising campaign to support surrounding communities in need. The company, together with Advent and individual donors, committed BRL400k (~USD77k), which paid for the donation of 70 tons of food and medical supplies. … download the full case study to read more.

You may be interested in...

-

Lightrock | dr.consulta

In December 2017, Lightrock invested in dr.consulta, a Brazil-based clinic chain that...

-

Elevar Equity | TICMAS

In June 2018, Elevar Equity invested in TICMAS, an education platform with operations in...

-

Vinci Partners | Pro Infusion

In November 2020, Vinci Partners invested in Pro Infusion, a Brazil-based outsourcing...

-

L Catterton | NotCo

In August 2020, L Catterton invested in NotCo, a Chile-based foodtech company that...