Entrepreneur Profiles

The IoT Opportunity in Latin America: An Interview With Cobli Co-Founder & CEO Parker Treacy

11 August 2021

Company: Cobli

Investors: Valor Capital Group, NXTP, Qualcomm Ventures, SoftBank, Fifth Wall Ventures, GLP

Interview with: Co-Founder & CEO Parker Treacy

Cobli, a Brazil-based telematics and fleet management platform founded by Parker Treacy and Rodrigo Mourad in 2017, recently raised a USD35m Series B led by SoftBank, with participation from Qualcomm Ventures, and follow-on from NXTP, Valor Capital Group and Fifth Wall Ventures.

LAVCA interviewed Co-Founder & CEO Parker Treacy on the current opportunity for IoT system implementations in Latin America, the company’s current go-to-market strategy, and the main challenges for providing a hardware-based solution.

LAVCA: Walk us through the IoT opportunity in Latin America. How does Cobli fit into this space?

Parker Treacy: In the US, the rise of IoT or telematics systems is undeniable, with companies like Samsara raising big rounds and attaining huge market penetration. The rise of telematics in Latin America is also undeniable, but as with all B2B platforms in the region, adoption typically has about a seven-year lag compared to the US market.

If we look at Latin American companies that manage fleets, 85% of them do not use any type of system like ours. The market is really blue ocean space. However, we do recognize that even if we’re currently competing with an unsophisticated incumbent – which for the most part is walkie-talkies and paper logs – we still need to remove a legacy system in order to replace it with a new one.

Of the 15% of companies that do use some type of fleet management system, they usually employ platforms that don’t even consider themselves telematics companies, but rather security companies, which are are only useful whenever a vehicle gets stolen, or you need to recover lost inventory. Our team takes another approach: we think that productivity affects everybody, and want to be the first ones to really bring telematics and company field operations workflows together.

We are selling into a blue ocean opportunity, but even within that white space, our value proposition is very different from what other incumbents can offer. Our big vision is to become the workflow software of every field operation in all Latin America. There’s really nobody doing it, and logistics is 13% of the GDP in the entire region.

What are some of the cost-saving and productivity increase initiatives you’re focused on?

Gas and insurance are two of the biggest segments that we believe the telematics industry is going to fundamentally transform.

If you look at a fleet’s expense line items, you’ll see that the biggest expense – by far – is gas, followed by driver-related expenses and insurance. In fact, fleets consume more than 50% of all gas consumption in Brazil.

A third important piece for us is maintenance optimization. Our vision for this category is still blurry, but we would love to eventually integrate a company’s fleet management system with repair shops across the country to manage repair scheduling and payments.

How steep is the learning curve for companies to take advantage of your data insights?

A generic statement for all B2B software in Latin America is that education is a very important part of the onboarding process for new clients. In our case, we approach this education process through a marketing angle. It’s important to say, however, that we get a big mix of levels of sophistication for first-time buyers, ranging from the ones that only need to understand insights around their fleet’s fuel consumption, to the ones that need to solve specific routing and dispatch challenges. Typically, the larger the fleet, the higher the level of existing sophistication of the client.

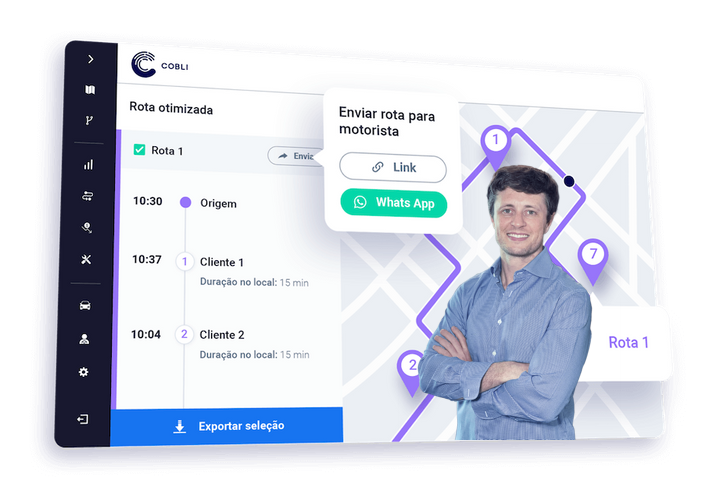

If you are a smaller company that doesn’t have very defined workflows, all you want to do is stare at a map and see where your vehicles are and use some basic analysis features. Our job there is to slowly help you incorporate new suggestions and features into your workflow to increase the level of sophistication of your internal processes. We aim to optimize the way companies already think about their businesses, instead of establishing new frameworks for them to adapt to.

What are some of the main challenges you’re currently facing when deploying your monitoring infrastructure?

Besides data collection, one of the main challenges we are solving is making the collected data available in real-time. We have many of the biggest ambulance fleets in Brazil that want us to help them minimize their average response time during emergencies, and that can only happen if we set our systems to release precise information in real-time.

For Cobli, data collection and analysis is one of our key strategic priorities as we aim to optimize for “data gravity”, or the gravitational force of more data.

Let’s walk through two examples: We just launched a fuel card for drivers. If we can integrate this card with some of the major gas stations in Brazil, we can offer differentiated gas products through our system. If we have the biggest dataset of real-time movement of cars, we can help them make better gas consumption decisions, and also help gas providers implement dynamic pricing and differentiated payment terms for their products. This is an example of the power of data gravity.

The second example: We are about to launch an insurance product, and using our data, we can price insurance better than anyone else can, and provide products that don’t even exist yet, including cheaper insurance, or insurance that could turn on and off dynamically.

Just like gravity, operational data pulls in a lot of other types of data, and makes other products much more valuable.

Is your current go-to-market strategy focused on bringing onboard large enterprise clients or SMEs?

We are currently focused on going upmarket and bringing more large enterprise companies into our systems. Selling to large enterprises is the most capital efficient way to grow. Our revenue retention with a lot of these clients is ~140%. We won’t ignore the SMEs, but moving upmarket is an important part of our growth path.

Why does Cobli rely on providing standalone sensors instead of offering drivers a software application that can be accessed through their phones, especially considering that hardware manufacturing is more capital intensive?

The hardware element is a necessary evil. We already use cellphones for tracking, and to enable better communication between the fleet manager and the service technician. But the minimum cellphone price point that has the necessary sensors built in typically is between BRL1,200-1,400, whereas our hardware costs a few hundred reais. We also found that data reliability is much higher with a standalone sensor than with a cellphone doing hundreds of other operations per minute.

Another challenge is integration with OEMs. Even though about a third of commercial vehicles in Brazil already have GPS and accelerometer – the two most basic sensors in our IoT hardware – we are actually duplicating sensors by providing our own hardware, because car manufacturers don’t have open data systems or proper APIs for us to integrate our platform.

We are also developing a dash cam that can see in four directions and detect faces and license plates. This is something SoftBank and Qualcomm are really into, and they are also excited about this project within Cobli. Collecting this kind of data feed is truly the final frontier for IoT.

As of August 2021, Cobli is one of the latest known IoT startups in Latin America to raise capital. Other local IoT startups that have announced funding in 2021 include: Fracttal (Brazilian IoT asset management platform), Instacrops (Chilean sensor-based crop monitoring platform), and Monuv (Brazilian computer vision platform for security cameras networks).

You may be interested in...

-

Is AI a Thing in Latin America? In Conversation with Hi Ventures

LAVCA sits down with Hi Venture to discuss their evolving thesis and vision for...

-

The Future of B2B Startup Investing in LatAm: In Conversation with NXTP

NXTP Ventures recently reached a USD98m final close for NXTP Fund III, its third...

-

A 20-Year Journey: An Interview with Technisys CEO Miguel Santos

Company: Technisys Investors: KASZEK, Dalus Capital, Riverwood Capital Interview...

-

Satellite Analytics & Irrigation Systems: Interview with Kilimo COO Tatiana Malvasio

Company: Kilimo Investors: NXTP Ventures, Alaya Capital, The Yield Lab, Xpand...