Key Takeaways

Experienced managers capitalized on their track records to attract an outsized share of LP commitments.

- Despite headwinds from high-interest rates and an uncertain economic environment, fundraising for Latin American-dedicated strategies hit its second-highest year on record with USD10.1b secured across 94 funds.

- Experienced fund managers (those on fund IV or greater) captured 72% of investor dollars, marking the highest concentration for experienced managers over the last five years.

- Notable fund closes over USD250m include Mexico Infrastructure Partners’ FIECK 23 (USD2.4b), Mubadala Capital’s Brazil Special Opportunities Fund II (USD710m), KASZEK Ventures Fund VI (USD540m) and Opportunity Fund III (USD435m), Jive’s Distressed and Special Situations Fund IV (USD503m), Bicycle Capital’s Fund I (USD440m), XP’s Private Equity Fund II (USD319m), Kans Capital’s Growth Fund I (USD280m) and Trelia Energy Advisor’s energy infrastructure fund for the Dominican Republic (USD271m).

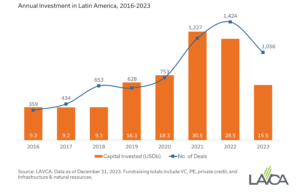

Private capital investment slid from record peaks in 2021 and 2022 amid a slower investment environment.

- The pace of capital deployment in the region slowed as investors deployed USD15.5b across 1,056 deals in VC, PE, infrastructure and private credit in 2023, a nearly 50% decline compared to peaks in 2021 and 2022.

- Private credit funds continue to expand in the region through loans to SMEs, distressed companies and infrastructure projects, filling a financing gap not being addressed by traditional lenders in the region. The number of private credit deals closed in the region reached

a new high in 2023, growing from 132 in 2022 to 164 in 2023.

Investors deployed USD4b across 770 VC deals in 2023, down from USD7.9b across 1,158 deals in 2022.

- Quarterly VC investment has stabilized, averaging USD1b per quarter since Q3 2022. Early-stage sustained investment activity in Latin America, primarily supported by local fund managers. Capital invested in early-stage rounds accounted for 42% of venture dollars deployed in 2023. Venture debt also continued to be an important source of funding, albeit highly concentrated.

LAVCA’s Industry Data & Analysis is available on a quarterly basis as a benefit for LAVCA Members. LAVCA’s 2024 Industry Data & Analysis includes insights on:

- Aggregate statistics on private capital investment in Latin America by deal size, country, asset class and industry

- 717 disclosed private capital transactions across Latin America

- VC breakout with analysis of activity by stage, country, sector, investor HQ, ticket size and tech vertical

- Aggregate statistics on private capital fundraising in Latin America

- 56 Latin America-dedicated funds with closes in 2023

- Aggregate statistics on private capital exits in Latin America

- Notable exits and listings in 2023

LAVCA Members can log in to download the 2024 Industry Data & Analysis Excel file and full PDF report. Non-members may purchase the report.