Search Results

Search results for: "rappi" in All Categories

-

27 September 2022

Colombia’s RappiPay Secures USD11m Syndicated Credit Line from Bancolombia, Others

(Latam Fintech) RappiPay, a Colombia-based payments platform joint venture...

-

19 July 2021

T. Rowe Price Leads USD500m Series F Round for Rappi

T. Rowe Price led a USD500m Series F round for Colombian on-demand...

-

25 September 2020

Rappi Raises US$300m from T. Rowe Price Associates and Others

Rappi raised US$300m from T. Rowe Price Associates and other undisclosed...

-

2 May 2019

Valor Econômico: Softbank Investe US$ 1 bi no Rappi e pressiona Movile

-

30 April 2019

Globo: Rappi Recebe US$ 1 bilhão do Fundo Japonês Softbank

-

30 April 2019

Crunchbase: Colombian On-Demand Delivery Unicorn Rappi Raises $1B From SoftBank

-

30 April 2019

SoftBank Invests US$1b in Colombian Delivery App Rappi

SoftBank will invest US$1b in Colombian delivery app Rappi, split 50/50...

-

7 February 2019

Rappi Acquires Mexican Blockchain-based Payments Platform Payit (en español)

Rappi acquired Payit, a Mexican blockchain-based payments platform, for an...

-

31 August 2018

Colombia's Rappi Reaches Unicorn Status with US$200m Investment Round Led by DST Global

DST Global led a US$200m investment round in Colombian on-demand delivery...

-

24 January 2018

Undisclosed Investors Make Investment Rappi (en español)

UPDATE: Bloomberg reports that as of February 27, 2018 Rappi has raised...

-

1 December 2016

Entrepreneur Profile: Simón Borrero, Co-founder & CEO, Rappi

After raising capital from local investors, Colombian delivery startup...

-

27 July 2016

Andreessen Horowitz, Sequoia, DST Global Invest in Colombian App Rappi (en español)

Andreessen Horowitz invested an undisclosed amount in Rappi, a Colombian...

-

2 February 2023

Lightspeed Venture Partners Leads USD13m Series A for Mexico’s Beek

(TechCrunch) Lighstpeed Venture Partners led a USD13m Series A for Beek, a...

-

29 August 2022

Upload Ventures Leads a USD12m Series A for Mexico’s Plerk

(Bloomberg Linea)Upload Ventures led a USD12m Series A for Plerk, a...

-

25 August 2022

CRV and monashees Lead USD6.7m Pre-seed Round for Brazil’s Latú

(Bloomberg Línea) CRV and monashees led a USD6.7m pre-seed round for...

-

10 June 2022

Mexico’s Ozon Raises USD4m Seed Funding and USD25m Debt

Architect Capital provided USD25m in debt for Mexico-based motorcycle...

-

7 February 2022

2022 LAVCA Trends in Tech

Access LAVCA’s 2022 LAVCA Trends in Tech, which breaks down 2021 VC...

-

20 October 2021

Brazilian Wholesale Marketplace Inventa Raises ~USD6m Seed Round (em português)

Inventa, a Brazilian wholesale marketplace connecting regional wholesalers...

-

28 September 2021

Advent International and SoftBank Lead USD225m Series B for E-commerce Aggregator Merama

Advent International and SoftBank led a USD225m Series B for Merama, a...

-

22 September 2021

monashees and Valor Capital Group Lead ~USD4.6m Round for Brazilian Financial Management Platform BHub (em português)

monashees and Valor Capital Group led a ~USD4.6m pre-seed round for BHub,...

-

2 September 2021

CRV Leads USD57m Series B for Expense Management Platform Jeeves

Jeeves, a US-based expense management platform for startups with...

-

3 August 2021

General Atlantic and SoftBank Lead ~USD125m Round for Brazilian Digital Protection Platform unico

General Atlantic and SoftBank led a ~USD125m round for unico, a...

-

3 August 2021

General Atlantic and SoftBank Lead ~USD125m Round for Brazilian Digital Protection Platform unico

General Altantic and SoftBank led a ~USD125m round for unico, a Brazilian...

-

27 July 2021

Kingsway Capital Leads USD16.3m Series A for Argentine Crypto Platform Lemon

Kingsway Capital led a USD16.3m Series A for Lemon, an Argentine crypto...

-

14 July 2021

Mexican Employee Benefits Platform Plerk Raises USD1m Pre-Seed Round

Plerk, a Mexican employee benefits platform, raised a USD1m pre-seed round...

-

13 July 2021

WE Ventures Invested ~USD1.1m in Brazilian Marketing Intelligence Platform Mobees (em português)

We Ventures invested ~USD1.1m in Mobees, a Brazilian marketing...

-

1 June 2021

Mexican Fintech Belvo Raises USD43m Series A

Belvo, a Mexican fintech providing a financial services API for mobile...

-

1 June 2021

GGV Leads USD65m Series B in Colombian Restaurant and Retail Platform Frubana

GGV led a USD65m Series B round in Frubana, a Colombian B2B platform of...

-

18 May 2021

Minerva Foods and Quartz Lead BRL120m Series B for Brazilian Delivery Platform Shopper (em português)

Brazilian beef exporter Minerva Foods and Quartz led a BRL120m Series B...

-

12 May 2021

monashees and Index Ventures Leads USD9m Seed Round in Argentine fintech Pomelo

monashees and Index Ventures led a USD9m seed round for Pomelo, an...

-

12 May 2021

Better Tomorrow Leads USD3.6m Seed Round for Brazilian Financing Platform Divibank

Better Tomorrow led a USD3.6m seed round for Divibank, a Brazilian...

-

12 May 2021

Homebrew Leads BRL14m Seed Round for Brazilian Digital Bank Z1 (em português)

Homebrew led a BRL14m seed round for Z1, a Brazilian digital bank for...

-

28 April 2021

Valor Capital Group, monashees and Balderton Capital Lead USD160m Funding for Merama

Valor Capital Group, monashees and UK-based VC Balderton Capital led a...

-

27 April 2021

FJ Labs and Alex Oxenford Invest USD3.5m in Brazilian Data Privacy and Storage Platform DRIC (em português)

FJ Labs and Alec Oxenford (letgo) invested USD3.5m in DRIC, a Brazilian...

-

22 April 2021

TMT Investments and Copernion Capital Partners Lead USD22m Series A for Colombian Foodtech Muncher (en español)

TMT Investments and Copernion Capital Partners led a USD22m Series A for...

-

20 April 2021

Cometa (Variv Capital) Leads USD5m Seed Round for Colombian Financial Platform Simetrik

Cometa (formerly Variv Capital) led a USD5m seed round for Simetrik, a...

-

10 March 2021

Canary Leads BRL3.6m Round for Brazilian On-Demand Sales Talent Platform Cloud Humans (em português)

Canary led a BRL3.6m round for Cloud Humans, a Brazilian on-demand...

-

28 February 2021

CapSur Capital Leads ~USD205m Round for Delivery Logistics Platform Loggi

CapSur Capital led a ~USD205m round for Brazil-based delivery logistics...

-

5 February 2021

Alaya Capital Partners, Potencia Ventures, Mr. Pink, and Winnipeg Invest US$600k in Talently (en español)

Alaya Capital Partners, Potencia Ventures, Mr. Pink, and Winnipeg made a...

-

8 December 2020

Volpe Capital Reaches US$50m First Close for Early Stage Latin America Fund (em português)

Volpe Capital, a VC fund founded by former SoftBank Managing Partner Andre...

-

3 December 2020

Accion Venture Lab, Emles Venture Partners, and Noveus VC Invest US$1.5m in Henry

Accion Venture Lab, Emles Venture Partners, and Noveus VC invested US$1.5m...

-

19 October 2020

PortfoLion and NCRD Invest US$5.3m in Polish Ecommerce Marketing Platform edrone (em português)

Budapest-based VC fund PortfoLion and the Polish National Center for...

-

16 October 2020

KaszeK Ventures, monashees, and WIND Ventures Lead US$12m Series A in Colombian e-commerce Chiper

KaszeK Ventures, monashees, and WIND Ventures, the CVC fund of Chilean...

-

5 October 2020

Igah Ventures Leads R$6m Round in Brazilian Beauty Startup Dr. Jones (em português)

Igah Ventures led a R$6m round in Dr. Jones, a Brazilian DTC brand for...

-

29 July 2020

Redpoint eventures Leads US$11m Series B in Magnetis

Redpoint eventures led a US$11m Series B in Magnetis, a Brazilian personal...

-

28 July 2020

Allievo Capital, Caravela Capital, and Fundação Estudar Invest in Motorbike Rental Mottu

Allievo Capital, Caravela Capital, and Fundação Estudar invested US$2m...

-

9 July 2020

Soma Capital, InQlab, and Palm Drive Capital Invest US$5m in Pet Goods Platform LAIKA

Soma Capital, InQlab, and Palm Drive Capital invested US$5m in LAIKA, a...

-

30 June 2020

Mountain Nazca and Foundation Capital Lead a US$12m Bridge Round in Grocery Delivery Startup Jüsto

Mountain Nazca and Foundation Capital led a US$12m follow-on investment in...

-

17 June 2020

Redpoint eventures Leads a US$2.3m Round in Customer Intelligence Platform Arena

Redpoint eventures led a US$2.3m seed round in San Francisco-based Arena,...

-

3 June 2020

Valor Capital and Redpoint eventures Lead a US$47m Series B in Tembici

Tembici, a Brazilian micro-mobility platform focused on bikes, raised a...

-

1 June 2020

SoftBank Latin America Fund Leads a US$22m Series B in Cortex

Cortex, a Brazilian SaaS marketing and sales growth platform, raised a...

-

6 May 2020

Canary, Atlantico, and Big Bets Lead a R$7.5m Round in Festalab

Canary, Atlantico, and Big Bets led a R$7.5m round in Brazilian event...

-

23 April 2020

ALLVP and NFX Lead a US$5.3m Invesment in Nuvocargo

ALLVP and NFX led a US$5.3m seed round in Nuvocargo, a Mexican managed...

-

13 April 2020

GGV and monashees Lead a US$25m Series A in Frubana

Frubana, a Colombian B2B platform of agri-products for restaurants and...

-

8 April 2020

iFood Acquires Majority Stake in Domicilios

iFood completed a majority acquisition of Domicilios, which Delivery Hero...

-

20 February 2020

Redpoint Eventures and DNA Capital Invest US$4.5m in Memed

Redpoint eventures and DNA Capital, the corporate venture arm of DASA, led...

-

7 February 2020

Redpoint Eventures Invests US$4m in Kzas

Redpoint eventures led a US$4m seed investment in Kzas, a Brazilian...

-

30 January 2020

Iporanga Ventures Invests in Brazilian Startup, Stark Bank

Iporanga Ventures led an undisclosed investment in Stark Bank, a Brazilian...

-

17 December 2019

Avalancha Ventures, Soldiers Field Angels, 0BS, and Others Invest in Bayonet

Bayonet, a Mexican fraud detection startup, raised US$500k from Avalancha...

-

5 December 2019

monashees, Valor Capital, and Canary Invest R$38m in Mimic (em português)

monashees, Valor Capital, and Canary invested R$38m in Mimic, a Brazilian...

-

29 November 2019

Redpoint eventures Invests R$50m in Housi (em português)

Redpoint eventures made a R$50m investment in Housi, a Brazilian property...

-

25 November 2019

Tencent and SoftBank Lead a US$150m Series C Investment in Ualá

Tencent and SoftBank led a US$150m investment in Ualá, an Argentine...

-

22 November 2019

SoftBank Leads a US$140m Investment in VTEX

SoftBank led a US$140m investment in VTEX, a Brazilian ecommerce SaaS...

-

17 October 2019

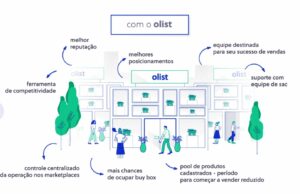

SoftBank Leads a R$190m Investment in Olist (em português)

SoftBank led a R$190m investment in Olist, a Brazilian e-commerce...

-

17 October 2019

ALLVP and InQlab Invest ~US$2.5m in Slang (en español)

ALLVP and InQlab invested ~US$2.5m in Slang, a Boston-based edtech focused...

-

7 October 2019

SoftBank Latin America Fund and Grupo Globo Invest in Buser

Brazilian bus ticketing platform Buser raised an undisclosed round from...

-

24 September 2019

Global Founders Capital Leads a R$4m Investment in LAR.app (em português)

Global Founders Capital led a R$4m investment in LAR.app, a Brazilian...

-

24 July 2019

Quest Venture Partners, Magma Partners, and Others Invest in Brazilian Crowdsourcing Dataplor

Dataplor, a Brazilian startup crowdsourcing local retail market...

-

20 June 2019

Frubana Raises US$12m Over Two Rounds

Colombian agtech Frubana raised US$12m over two rounds. monashees, Y...

-

7 June 2019

Magma Partners Makes Undisclosed Investment in Truora

Magma Partners made an undisclosed investment in Truora, a Colombian fraud...

-

6 June 2019

Foundation Capital Invests US$6m in Colombian Edtech Platzi

Foundation Capital made a US$6m investment in Colombian edtech Platzi....

-

15 May 2019

Monashees Leads US$10.5m Seed Investment in Rental Car Provider Kovi (em português)

Monashees led a US$10.5m seed investment in Kovi ,provider of rental cars...

-

10 May 2019

Andreessen Horowitz Invests US$1.6m in Uruguayan Startup Meitre (en español)

Andreessen Horowitz made a US$1.6m investment in Meitre, an Uruguayan...

-

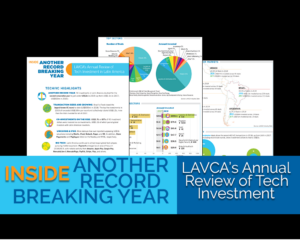

6 May 2019

Inside Another Record Breaking Year: 2019 Review of Tech Investment

Access LAVCA's Annual Review of Tech Investment in Latin America, an...

-

28 March 2019

Propel Ventures, Variv Capital & FEMSA Comercio Make US$13m Follow-on in Conekta (en español)

Propel Ventures led a US$13m investment in Conekta, a Mexican fintech...

-

6 December 2018

HSI Investimentos Exits Brazilian Self-Storage Company GoodStorage (em português)

Brazilian private equity firm Hemisfério Sul Investimentos (HSI) sold a...

-

8 November 2018

ALLVP Raises US$73m In First Round for New Fund

ALL-VP has held a first close of US$73m for its latest investment...

-

7 November 2018

monashees Closes US$150m 8th Fund for Investment in Latin America

monashees closed its seventh VC fund, a US$150m vehicle, with...

-

30 October 2018

Sequoia Capital Invests US$2.25m in Mexican Startup Rever (en español)

Sequoia Capital and Zetta Venture Partners invested US$2.25m in Rever, a...

-

25 October 2018

Spectrum 28 Capital Leads US$2m Investment in Colombian Edtech Ubits (en español)

UBits, a Colombian edtech platform for corporate training, raised US$2m...

-

16 October 2018

SoftBank Invests US$100m in Brazilian Shipping Logistics Platform Loggi

SoftBank invested US$100m in Loggi, a Brazilian shipping logistics...

-

11 October 2018

Family Office Leads R$5m Investment in Brazilian E-Commerce Locker Startup Alfred (em português)

The Gontijo family office led a R$5m investment in Alfred, a Brazilian...

-

13 July 2018

Y Combinator and Others Invests US$800k in Colombian Tax Automation Platform Tributi (en español)

Tributi, a Colombian tax automation platform, raised US$800k from Y...

-

12 July 2018

Movile Raises US$124m for Brazilian On-Demand Food Delivery Company iFood

Movile raised a fresh US$124m round of financing for iFood, led by...

-

17 June 2018

Colombian Corporate Learning Platform Ubits Receives US$120k Investment from Y Combinator (en español)

Ubits, a Colombian corporate learning platform, will receive a US$120k...

-

5 June 2018

Salesforce Ventures Makes Inaugural LatAm Investment in RunaHR

Salesforce Ventures made its inaugural investment in Latin America in...

-

3 May 2018

monashees+, Quona Capital & Propel Venture Partners Lead US$22m Series A in Brazilian Fintech Neon

Propel Ventures Partners, monashees +, and Quona Capital led a US$22m...

-

9 February 2018

Endeavor Closes Fund with US$85m in Commitments (en español)

Endeavor closed its Endeavor Catalyst II, a co-investment vehicle designed...

-

11 January 2018

State of the Industry: 2017 VC Deal Activity & Highlights

The entrance of major global investors into a string of recent early and...

-

20 December 2017

Mercado Libre, NXTP Labs & Alaya Capital Team Up to Invest in 123Seguro

MercadoLibre (through its MeLi fund), NXTP Labs, and Alaya Capital made a...

-

18 September 2017

Corporate Venture in Brazil Gains Steam as Giants Amp up Startup Investments

LAVCA’s 2017 Latin American Startup Directory shows that of the 144...

-

29 June 2017

Naspers and Innova Capital Invest US$53m in Movile

Naspers and Innova Capital invested a total of US$53m in Brazil-based...

-

21 June 2017

Y Combinator Invests in Colombian Startup Tpaga (en español)

Y Combinator will invest more than US$100k in Colombia-based mobile...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...

-

28 June 2016

Movile Raises US$40m from Naspers and Innova Capital

Movile, Latin America’s leading mobile commerce platform, announced it...

-

16 June 2016

KKR & Mexico's Pemex Set to Work on US$1.2b Sale Agreement

(Reuters) KKR and Mexico’s Pemex are reportedly working on a US$1.2b...

-

23 September 2014

Startup Stock Exchange Ready To Take Startups Public–In Curacao

(WSJ) Enter the Startup Stock Exchange (SSX), an effort to enable small...