Search Results

Search results for: "quintoandar" in All Categories

-

18 August 2021

Greenoaks and Tencent Lead USD120m Series E+ for Brazilian Proptech QuintoAndar

Greenoaks and Tencent led a USD120m Series E+ for Brazilian proptech...

-

27 May 2021

Ribbit Capital Leads USD300m Series E for Brazilian Proptech QuintoAndar

Ribbit Capital led a USD300m Series E for Brazilian proptech QuintoAndar,...

-

10 September 2019

Softbank Invests US$250m Series D in Brazilian Apartment Rental Platform QuintoAndar

Brazilian proptech QuintoAndar reached unicorn status with a US$250m...

-

22 April 2019

Inside QuintoAndar’s Ascendancy in Brazilian Real Estate Tech: Interview with CTO Andre Penha

QuintoAndar is a breakout Brazilian real estate startup that CBInsights...

-

26 November 2018

General Atlantic Invests R$250m in Brazilian Apartment Rental Platform QuintoAndar

General Atlantic invested R$250m in Brazilian apartment rental platform...

-

12 December 2016

Acacia Partners and Qualcomm Ventures Invest US$12.6m in QuintoAndar (em português)

(Press Release) Apartment rental marketplace, QuintoAndar, has received a...

-

28 October 2021

Astella Investimentos Leads ~USD5m Round for Brazilian Proptech Homelend (em português)

Astella Investimentos led a ~USD5m round for Homelend, a Brazilian real...

-

5 October 2021

Mercado Libre and KASZEK SPAC Raises USD287m In Public Listing

MELI Kaszek Pioneer Corp (MEKA), a SPAC formed by Mercado Libre and...

-

2 September 2021

CRV Leads USD57m Series B for Expense Management Platform Jeeves

Jeeves, a US-based expense management platform for startups with...

-

1 September 2021

KASZEK and monashees Lead ~USD9m Seed Round for Brazilian Lending Platform TruePay (em português)

KASZEK and monashees led a ~USD9m seed round for TruePay, a Brazilian...

-

18 June 2021

QED Investors Leads USD30m Series B for Brazilian Solar Energy Financing Platform Solfácil

QED Investors led a USD30m Series B for Solfácil, a Brazilian solar...

-

1 June 2021

Endurance Investments Leads BRL210m Series C for Brazilian Identity Authentication Platform idwall (em português)

Chilean VC fund Endurance Investments led a BRL210m Series C for idwall, a...

-

17 May 2021

Alaya Capital, Y Combinator, Goodwater, ONEVC and Vast VC invest USD8m in Proptech Houm

Houm, a Chilean home purchase and rental marketplace with operations in...

-

20 April 2021

QED Investors Leads UDD15m Series B for Brazilian Payment Services Provider Hash

QED Investors led a USD15m Series B for Hash, a Brazilian payment services...

-

27 January 2021

QED Investors Leads US$6m Round in Lending Platform Milo

QED Investors led a US$6m round in Milo, a Colombia- and Miami-based...

-

15 January 2021

KaszeK Ventures Leads R$20m Series A in Brazilian Customer Service Platform OmniChat

KaszeK Ventures led a R$20m Series A in OmniChat, a Brazilian chat-based...

-

14 January 2021

SoftBank Latin America Leads Series C Investment in Brazilian Fiscal and Accounting System Contabilizei

SoftBank Latin America led an undisclosed Series C in Contabilizei, a...

-

10 December 2020

KaszeK Ventures and QED Investors Lead US$62m Series B in Bitso

KaszeK Ventures and QED Investors led a US$62m Series B in Bitso, a...

-

8 December 2020

Volpe Capital Reaches US$50m First Close for Early Stage Latin America Fund (em português)

Volpe Capital, a VC fund founded by former SoftBank Managing Partner Andre...

-

19 November 2020

monashees, ONEVC, and Y Combinator Lead US$5m Seed Round in Brazilian Fintech Facio

monashees, ONEVC, and Y Combinator led a US$5m seed round in Facio, a...

-

21 September 2020

General Atlantic and SoftBank Lead US$108m Series B in Acesso Digital

General Atlantic and SoftBank’s Latin America Fund led a US$108m Series...

-

27 February 2020

QED Investors Closes Its Sixth Fund with US$350m in Commitments

QED Investors closed its sixth fund with US$350m in commitments....

-

3 January 2020

Andreessen Horowitz, Vulcan Capital, Jaguar Ventures and Others Invest US$175m Series C in Loft

Andreessen Horowitz and Vulcan Capital led a US$175m Series C in Brazilian...

-

22 November 2019

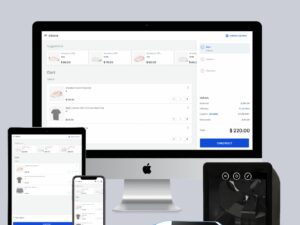

SoftBank Leads a US$140m Investment in VTEX

SoftBank led a US$140m investment in VTEX, a Brazilian ecommerce SaaS...

-

17 October 2019

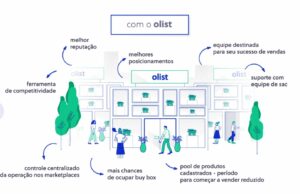

SoftBank Leads a R$190m Investment in Olist (em português)

SoftBank led a R$190m investment in Olist, a Brazilian e-commerce...

-

7 October 2019

SoftBank Latin America Fund and Grupo Globo Invest in Buser

Brazilian bus ticketing platform Buser raised an undisclosed round from...

-

17 September 2019

Vostok Emerging Finance Leads a US$13m Investment in Xerpa (em português)

Vostok Emerging Finance led a US$13m investment in Xerpa, a Brazilian...

-

4 September 2019

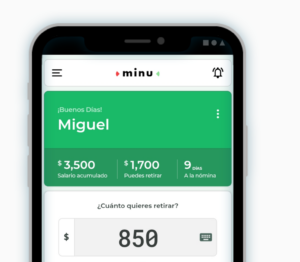

QED Investors, Village Global, Next Billion Ventures, and Mountain Nazca Mexico Invest US$6.5m in minu

minu, a payroll fintech providing Mexican employees digital access to...

-

29 August 2019

KaszeK Ventures Raises US$600m Across Two New Funds

KaszeK Ventures raised US$600m across two new funds, including US$375m for...

-

26 March 2019

QED & Invus Co-Lead US$22.6m Investment in Brazil's Escale

QED Investors and Invus Opportunities co-led a US$22.6m investment in...

-

20 February 2016

Startup Recieves US$7m to Reinvent Real Estate Market (em português)

(Exame) Kaszek led a US$7m Series A round in Brazilian real estate...