Search Results

Search results for: "movile" in All Categories

-

14 January 2022

Movile Leads ~USD16.3m Series B for Brazilian Revenue-Based Lender a55

Movile led a ~USD16.3m Series B for a55, a Brazilian revenue-based lender...

-

26 August 2021

Operating Leverage in Tech: An Interview with Movile CEO Patrick Hruby

Company: Movile Investors: Nasper’s Prosus Ventures, Innova Capital...

-

2 August 2021

Prosus Invests USD194m in Brazil’s Movile

Prosus Ventures invested USD200m in follow-on financing in Brazil-based...

-

30 June 2021

Movile Invests ~USD34m in Brazilian Fintech Platform Zoop (em português)

Movile invested ~USD34m in Zoop, a Brazilian white label fintech platform...

-

12 February 2021

Movile Leads Series A Investment in Argentine Last-Mile Delivery Platform Moova (en español)

Movile led an undisclosed Series A in Moova, an Argentine route...

-

22 September 2020

Movile Leads R$60m Round in Brazilian Fintech Zoop

Movile led a R$60m round in Zoop, a Brazilian white label fintech platform...

-

22 September 2020

BNamericas: Zoop recibe inversión de 60mn de reales liderada por Movile

-

2 May 2019

Valor Econômico: Softbank Investe US$ 1 bi no Rappi e pressiona Movile

-

14 November 2018

Valor: Movile investe US$ 500 milhões no iFood e planeja criar líder global

-

13 November 2018

Naspers, Innova Capital, and Movile Invest US$500m in iFood (em português)

Naspers, Innova Capital, and parent company Movile invest US$500m in...

-

12 July 2018

Movile Raises US$124m for Brazilian On-Demand Food Delivery Company iFood

Movile raised a fresh US$124m round of financing for iFood, led by...

-

15 March 2018

Movile Invests in Payment Solutions Startup Zoop (em português)

Movile made a US$18.3m investment in payment solutions startup Zoop, with...

-

5 January 2018

Movile Invests US$9m in Colombian Grocery Startup Mercadoni

Movile made a US$9m Series A investment in Colombian grocery delivery...

-

7 December 2017

Naspers & Innova Capital Invest US$82m in Movile to Expand iFood

South Africa-based media conglomerate Naspers and private equity firm...

-

29 November 2017

Movile Invests R$15m in Brazilian Ticketing Platform Sympla (em português)

Movile made a R$15m investment in Sympla, a Brazilian ticketing and event...

-

29 June 2017

Naspers and Innova Capital Invest US$53m in Movile

Naspers and Innova Capital invested a total of US$53m in Brazil-based...

-

19 December 2016

Movile's Sympla Acquires Eventick to Expand Leadership in Brazil (em português)

(Startupi) Brazilian online event platform Sympla has acquired Eventick to...

-

17 October 2016

Movile's Maplink Acquires Optilogistic

(Tech.eu) Optilogistic, a French logistics software company, has been...

-

23 September 2016

Leiturinha Receives R$3m from Movile (em português)

(Exame) Brazilian corporate venture investor Movile has invested R$3m...

-

20 July 2016

iFood Raises US$30m from Movile and JUST EAT and Expands into Mexico

Movile and Just Eat injected another US$30m into iFood, the leading online...

-

28 June 2016

Movile Raises US$40m from Naspers and Innova Capital

Movile, Latin America’s leading mobile commerce platform, announced it...

-

13 June 2016

Movile Invests R$13m in Brazilian Ticketing Startup Sympla

(Baguete) Movile announced an investment of R$13m in ticket startup...

-

19 November 2015

Lemann in Negotiates Million Dollar Investment in Movile

(Exame) Brazilian mobile content business, Movile, is in negotiations with...

-

1 June 2015

IFood Raises US$50m From Movile And Just Eat For Food Delivery

(Tech Crunch) Latin American mobile commerce powerhouse Movile and Just...

-

16 April 2015

Movile Receives R$125m Investment from Naspers (em português)

(Baguete) Movile, Brazil’s leading global mobile commerce platform,...

-

25 November 2014

Movile to Invest R$100m Across Latin America (em português)

(Baguete) Movile, the Brazil-based app development and mobile content...

-

20 October 2014

CinePapaya, the Startup of Peru's Gary Urteaga, Raises US$2M from Movile (en español)

(Pulso Social) Movile, the Brazilian internet conglomerate, is placing all...

-

25 September 2014

Movile Invests US$15m in Apontador, The Leading Local Business Reviews and Search Brand in Latin America

(Press Release) Apontador, the industry leading service that helps twenty...

-

29 August 2014

Warehouse Investimentos Sells its Entire Stake in iFood to Movile (em português)

(Startupi) Warehouse Investments, a venture capital fund created 3 years...

-

8 August 2014

Movile Receives Investment of R$125m (em português)

(E-Commerce) Movile, a mobile solutions provider, received financing of...

-

9 June 2014

Movile and 21212 Invest in Superplayer

(Baguete) 21212 and Movile are the new investors in music platform...

-

6 February 2014

Hungry For New Deals, Latin American Wireless Co. Movile Doubles Down On Delivery

(TechCrunch) Brazil’s mobile content developer Movile is on the hunt for...

-

6 February 2013

Movile Invests $2.6m in Brazilian Delivery Startup iFood

(TechCrunch) In the U.S., when we’re hungry and feeling lazy and don’t...

-

31 August 2022

PROSUS VENTURES ACQUIRES 33.3% STAKE IN IFOOD FOR ~USD1.5B

(Businesswire (Prosus)) Prosus Ventures acquired a 33.3% stake...

-

19 April 2021

Ashmore Invests in Electribus Bogota (en español)

Ashmore Group has invested an undisclosed amount in Electribus Bogotá, a...

-

12 January 2021

BuenTrip Ventures Leads US$1.25m Round in Ecuadorian Cybersecurity Platform Kriptos (en español)

BuenTrip Ventures led a US$1.25m in Kriptos, an Ecuadorian cybersecurity...

-

14 September 2020

Goldman Sachs Merchant Banking Leads R$120m Series A in Brazilian Fintech iugu

Goldman Sachs Merchant Banking led a R$120m Series A in iugu, a Brazilian...

-

26 August 2020

Redpoint eventures Leads US$5m Round in Computer Vision CyberLabs

Redpoint eventures led a US$5m round in CyberLabs, a Brazilian computer...

-

29 January 2020

Smart Money Ventures Leads a R$3m Investment in Gama Academy (em português)

Smart Money Ventures led a R$3m investment in Gama Academy, a Brazilian...

-

24 July 2019

Quest Venture Partners, Magma Partners, and Others Invest in Brazilian Crowdsourcing Dataplor

Dataplor, a Brazilian startup crowdsourcing local retail market...

-

6 May 2019

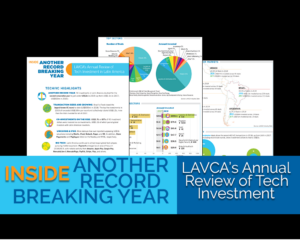

Inside Another Record Breaking Year: 2019 Review of Tech Investment

Access LAVCA's Annual Review of Tech Investment in Latin America, an...

-

26 April 2019

Redwood Ventures, Angels & Family Office Invest US$1.3m in Crabi (en español)

Crabi, a Mexican auto insurance startup, raised a US$1.3m seed round led...

-

8 March 2019

Smart Money Ventures Invests R$1m in Brazil's Produttivo (em português)

Smart Money Ventures made a R$1m investment in Produttivo, a software...

-

18 January 2019

Ideas y Capital's Portfolio Company Phunware Listed on NASDAQ (en español)

Ideas y Capital portfolio company Phunware, a Mexican mobile cloud...

-

26 October 2018

Innova Capital Leads R$22m Series A Round in Bom Pra Crédito (em português)

Innova Capital led a R$22m Series A investment in Bom Pra Crédito, a...

-

10 October 2018

Altor Estructuradores to List CKD Vehicle on Mexico’s BIVA (en español)

Altor Estructuradores is preparing to list a CKD on Mexico’s BIVA for...

-

21 September 2018

Fortem Capital Raises MXN$5,000m via BIVA Instead of BMV (en español)

Fortem Capital, a subsidiary of the IPB Group real estate company, seeks...

-

22 August 2018

Dux Capital Invests MX$600k in Airline Ticket Reselling Marketplace Refly (en español)

Dux Capital invested MX$600k in Refly, a platform for reselling airline...

-

1 August 2018

iFood Acquires Rapiddo for an Undisclosed Amount (em português)

On the heels of a US$124m fresh capital injection, iFood acquired Rapiddo...

-

15 June 2018

Alsagra Ventutres, Ajba Software, and Intelectix Invest in Mexican Cloud E-commerce Platform Muventa (en español)

Alsagra Ventures, Ajba Software and Intelectix made an undisclosed...

-

6 June 2018

NXTP Labs Announces New Investments

NXTP Labs announces new investments in Graphpath, Chazki, Uniko, Facenote,...

-

24 May 2018

Visa Leads US$12.5m Investment in Fintech YellowPepper

Visa led a US$12.5m strategic investment in Latin American fintech pioneer...

-

18 May 2018

BID Invest Commits $US5m to Argentinean Fintech Startup MONI Online (en español)

BID Invest made an initial investment of US$3m in Argentinean fintech...

-

7 May 2018

Inside Latin America's Breakout Year in Tech

Inside Latin America's Breakout Year in Tech is an 8-page graphic report...

-

7 May 2018

Alaya Capital Partners Makes Undisclosed Investment in Chilean Startup Rocketpin (en español)

Ayala Capital Partners made an undisclosed investment in Rocketpin, a...

-

11 February 2018

Axon Partners Invests in Peruvian Dating App Mi Media Manzana (en español)

Axon Partners made its first Peru investment in Mi Media Manzana, a dating...

-

16 January 2018

Wayra Chile Invests in ZappingTV, PostedIn & Cloner

Wayra Chile invested US$500k across three startups: ZappingTV, PostedIn,...

-

5 December 2017

Pomona Impact to Invest in Mexico's Energryn

Pomona Impact will invest US$250k in Energryn, a Mexican manufacturer of...

-

23 October 2017

Capital Invent and E Capital Lead US$2m Investment in Rescata (en español)

Capital Invent and E Capital led a US$2m investment in Rescata, a Mexican...

-

18 October 2017

Green Visor Capital Invests in Colombian Payment Platform Tpaga (en español)

Green Visor Capital in Silicon Valley led a US$2.2m investment in Tpaga, a...

-

14 October 2017

Santander InnoVentures Leads US$6m Investment in Mexico's ePesos (en español)

Santander InnoVentures led a US$6m investment in Mexico’s ePesos, a...

-

18 September 2017

Corporate Venture in Brazil Gains Steam as Giants Amp up Startup Investments

LAVCA’s 2017 Latin American Startup Directory shows that of the 144...

-

17 September 2017

Criatec 2 Invests R$5.8m in Fintech Platform Vindi

Criatec2, a fund managed by Bozano Investimentos, made a R$5.8m investment...

-

22 August 2017

Canary and Yellow Ventures Invest R$1.5m in HRtech Startup Gupy (em português)

Canary and Yellow Ventures invested R$1.5m in Gupy, an HR platform...

-

20 July 2017

Six Banks Launch Arfintech Fund to Invest in Financial Service Startups (en español)

Six Argentinian private banks with the involvement of NXTP Labs have...

-

13 July 2017

Parallel18 Ventures Invests in BrandsOf, Timokids and Be Better Hotels to Expand Throughout Puerto Rico (en español)

Puerto Rico accelerator Parallel18 invested US$75k each (US$225k total) in...

-

21 June 2017

Y Combinator Invests in Colombian Startup Tpaga (en español)

Y Combinator will invest more than US$100k in Colombia-based mobile...

-

29 May 2017

Northgate to Invest in Mexican Natural Gas Promoter Natgas Querétaro (en español)

Northgate Capital México will invest in Natgas Querétaro, a company that...

-

26 May 2017

Grupo RFP Invests US$500k in Peru's Joinnus (en español)

Grupo RFP invested US$500k in Joinnus, a Peru-based mobile and web...

-

6 April 2017

Ley de FinTech in the Works as FinTech Hurricane Hits Mexico (en español)

Mexico is in the process of passing Ley de FinTech to regulate the sector,...

-

13 March 2017

Two Mexican Youth Win Opciona and Telefonica Open Future_'s Premio Innovación Anticorrupción (en español)

Two mexican youth won Telefonica Open Future_ and Opciona’s...

-

19 December 2016

Wayra Argentina Accelerated Widow Games Receives US$250k Investment (en español)

Wayra Brasil, Acelera Partners, Microsoft Ventures, and Qualcomm Ventures...

-

7 December 2016

Wayra Peru Exits Cinepapaya (en español)

(Telefonica Open Future_) Wayra, the digital business accelerator of...

-

7 December 2016

Mountain Nazca Leads US$3m Investment in Kavak (en español)

(Expansión) Latin American venture capital fund Mountain Nazca has led a...

-

1 December 2016

Fandango Acquires Peru-based Cinepapaya

Movile and 500 Startups exited Peruvian movie ticket platform Cinepapaya,...

-

18 November 2016

Axon Partners Group & Velum Ventures Invest in Busqo.com and Asegúrate Fácil (en español)

(Press Release) Colombia’s Busqo.com (formerly RedSeguro) and...

-

19 October 2016

Recorrido.cl Receives US$600k (en español)

(Pulso Social) Mountain Nazca joins local and German investors in a...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...

-

11 May 2016

South Ventures Makes Follow-On Investment in Trocafone (en español)

(IG Angels) Brazilian e-commerce startup Trocafone has received a...

-

1 February 2016

EPG Partners Exits Nubox with Sale to Riverwood Capital (en español)

(Diario Financiero) Nubox, a Chilean firm that offers accounting, payroll...

-

11 January 2016

Alta Ventures Raises Fund for US$200m (en español)

(El Economista) Venture capital fund Alta Ventures Mexico plans to raise a...

-

12 December 2015

LIV Capital Increases Investment in Leading Digital Animation Studio Ánima Studios (en español)

(Sentido Común) LIV Capital’s Mexico Venture Capital Fund III,...

-

12 October 2015

Pig.gi Obtains Capital to Expand throughout Latin America (en español)

(El Economista) Pi.gi, a service that offers free internet in...

-

12 August 2015

Parkimovil Raises MX$10m and Seeks Expansion (en español)

(El Economista) INADEM-backed ON Ventures y Capital Invent make MX$10m...

-

23 June 2015

Undertone Acquires Argentinian Startup Sparkflow, Cygnus Capital's First Exit (en español)

(Pulso Social) Undertone, a U.S. company specializing in digital marketing...

-

17 June 2015

GetNinjas Receives Investment of R$40m led by Tiger Global Management (em português)

(Baguete) Get Ninjas received a round of investment totaling R$40m. The...

-

27 February 2015

Jampp, created in Argentina, Raises US$7m to Accelerate Growth (en español)

(PulsoSocial) Jampp, a leading platform for promotions and marketing of...

-

12 November 2014

South Ventures Invests In Brazil's Trocafone.com

(South Ventures) South Ventures invested part of SV Global Fund II into...