Search Results

Search results for: "konfio" in All Categories

-

8 November 2021

Mexican Konfio Secures USD80m Credit Line from Community Investment Management (en español)

Mexican fintech Konfio secured a USD80m credit line from Community...

-

29 September 2021

Tarsadia Capital and QED Investors Lead USD110m Series E+ for Mexican Fintech Konfio (en español)

Tarsadia Capital and QED Investors led a USD110m Series E+ for Konfio, a...

-

22 June 2021

Lightrock Leads USD125m Series E for Mexican Lending Platform Konfio (en español)

Lightrock led a USD125m Series E for Konfio, a Mexican lending platform...

-

25 February 2021

Goldman Sachs Grants USD60m Line of Credit to Mexican Lending Platform Konfio (en español)

Goldman Sachs granted a USD60m line of credit to Konfio, a Mexican lending...

-

25 September 2020

BID Invest Grants US$60m Line of Credit to Mexican Lending Platform Konfio (en español)

BID Invest granted a line of credit of up to ~US$60m to Mexican lending...

-

3 December 2019

SoftBank Leads a US$100m Investment in Konfio

SoftBank led a US$100m investment in Mexican lending platform Konfio, with...

-

6 September 2019

Konfio Raises US$250m Debt Round from Goldman & Victory Park Capital

Mexican lending platform Konfio raised a US$250m debt round from Goldman...

-

18 June 2018

Vostok Emerging Finance Leads US$25m Series C in Mexican Fintech Konfio

Vostok Emerging Finance led a US$25m Series C investment in Konfio, a...

-

11 October 2017

IFC Leads US$10m Series B in Mexico's Konfío

The International Finance Corporation (IFC) led a US$10m Series B...

-

25 May 2016

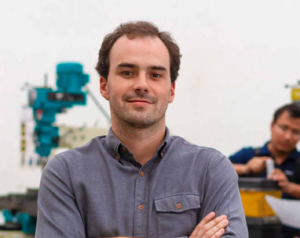

Entrepreneur Profile: David Arana, Founder & CEO, Konfío

Mexican fintech startup Konfio just secured a US$8m Series A from KaszeK...

-

24 May 2016

Online Mexican Lending Platform Konfio Raises US$8m in New VC Funding

(PEHub) Konfio, an online Mexican lending platform, has raised US$8m in...

-

7 February 2022

2022 LAVCA Trends in Tech

Access LAVCA’s 2022 LAVCA Trends in Tech, which breaks down 2021 VC...

-

5 October 2021

Mercado Libre and KASZEK SPAC Raises USD287m In Public Listing

MELI Kaszek Pioneer Corp (MEKA), a SPAC formed by Mercado Libre and...

-

18 June 2021

QED Investors Leads USD30m Series B for Brazilian Solar Energy Financing Platform Solfácil

QED Investors led a USD30m Series B for Solfácil, a Brazilian solar...

-

20 April 2021

QED Investors Leads UDD15m Series B for Brazilian Payment Services Provider Hash

QED Investors led a USD15m Series B for Hash, a Brazilian payment services...

-

27 January 2021

QED Investors Leads US$6m Round in Lending Platform Milo

QED Investors led a US$6m round in Milo, a Colombia- and Miami-based...

-

15 January 2021

KaszeK Ventures Leads R$20m Series A in Brazilian Customer Service Platform OmniChat

KaszeK Ventures led a R$20m Series A in OmniChat, a Brazilian chat-based...

-

22 May 2020

Quona Capital Leads a US$15m Round in Colombian Lending Platform ADDI

Quona Capital led a US$15m round in ADDI, a Colombian point-of-sale...

-

27 February 2020

QED Investors Closes Its Sixth Fund with US$350m in Commitments

QED Investors closed its sixth fund with US$350m in commitments....

-

29 August 2019

KaszeK Ventures Raises US$600m Across Two New Funds

KaszeK Ventures raised US$600m across two new funds, including US$375m for...

-

6 April 2017

Ley de FinTech in the Works as FinTech Hurricane Hits Mexico (en español)

Mexico is in the process of passing Ley de FinTech to regulate the sector,...

-

10 January 2017

500 Startups to Invest More than US$1m in New Latin American Startups (en español)

500 Startups has opened the seventh batch of its seed program in Mexico...

-

10 December 2016

Scotiabank Partners with QED Investors to Promote FinTech Start-ups in Latin America

(ACN Newswire) Scotiabank and QED Investors announced a partnership to...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...