Search Results

Search results for: "ifood" in All Categories

-

31 August 2022

PROSUS VENTURES ACQUIRES 33.3% STAKE IN IFOOD FOR ~USD1.5B

(Businesswire (Prosus)) Prosus Ventures acquired a 33.3% stake...

-

3 November 2020

Continental Grain Company Invests in Peru-based Multifoods

Global investor Continental Grain Company (CGC) has closed an investment...

-

8 April 2020

iFood Acquires Majority Stake in Domicilios

iFood completed a majority acquisition of Domicilios, which Delivery Hero...

-

14 November 2018

Valor: Movile investe US$ 500 milhões no iFood e planeja criar líder global

-

13 November 2018

Naspers, Innova Capital, and Movile Invest US$500m in iFood (em português)

Naspers, Innova Capital, and parent company Movile invest US$500m in...

-

1 August 2018

iFood Acquires Rapiddo for an Undisclosed Amount (em português)

On the heels of a US$124m fresh capital injection, iFood acquired Rapiddo...

-

12 July 2018

Movile Raises US$124m for Brazilian On-Demand Food Delivery Company iFood

Movile raised a fresh US$124m round of financing for iFood, led by...

-

7 December 2017

Naspers & Innova Capital Invest US$82m in Movile to Expand iFood

South Africa-based media conglomerate Naspers and private equity firm...

-

20 July 2016

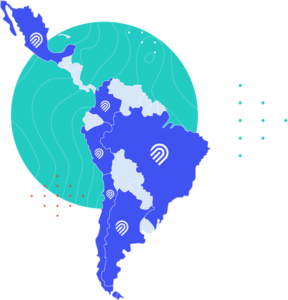

iFood Raises US$30m from Movile and JUST EAT and Expands into Mexico

Movile and Just Eat injected another US$30m into iFood, the leading online...

-

1 June 2015

IFood Raises US$50m From Movile And Just Eat For Food Delivery

(Tech Crunch) Latin American mobile commerce powerhouse Movile and Just...

-

29 August 2014

Warehouse Investimentos Sells its Entire Stake in iFood to Movile (em português)

(Startupi) Warehouse Investments, a venture capital fund created 3 years...

-

6 February 2013

Movile Invests $2.6m in Brazilian Delivery Startup iFood

(TechCrunch) In the U.S., when we’re hungry and feeling lazy and don’t...

-

22 August 2023

Tiger Global Leads USD61m Series B for Brazil’s Nomad

Tiger Global led a USD61m Series B for Nomad, a Brazil-based fintech...

-

27 September 2022

Chromo Invest, Canary, Others Invest BRL9m in Brazil’s Civi; Canary Leads USD1.1m in Pre-seed Round for Mexico’s Bendo

(Pipeline | LatamList) Chromo Invest led a BRL9m (~USD1.7m) round for...

-

25 October 2021

Brazilian Car Insurtech Justos Raises ~USD35.8m Series A from SoftBank, KASZEK and Others

Justos, a Brazilian pre-launch car insurance platform, raised a ~USD35.8m...

-

21 October 2021

Flourish Ventures and GFC Lead USD10m Series A for Brazilian Wholesale Marketplace Merce do Bairro

Flourish Ventures and GFC led a USD10m Series A for Merce do Bairro, a...

-

30 September 2021

Crescera Capital Leads USD80m Series C for Brazilian Mobility Platform Tembici

Crescera Capital led a USD80m Series C for Tembici, a Brazilian...

-

22 September 2021

monashees and Valor Capital Group Lead ~USD4.6m Round for Brazilian Financial Management Platform BHub (em português)

monashees and Valor Capital Group led a ~USD4.6m pre-seed round for BHub,...

-

2 August 2021

Prosus Invests USD194m in Brazil’s Movile

Prosus Ventures invested USD200m in follow-on financing in Brazil-based...

-

13 July 2021

WE Ventures Invested ~USD1.1m in Brazilian Marketing Intelligence Platform Mobees (em português)

We Ventures invested ~USD1.1m in Mobees, a Brazilian marketing...

-

8 July 2021

Brazilian Recruiting Platform Rocketmat Raises ~USD1.6m (em português)

Rocketmat, a US- and Brazil-based recruiting and employee retention...

-

7 July 2021

MFO Turim Leads ~USD2.4m Round for Brazilian Retail Investment Platform Guru (em português)

MFO Turim led a ~USD2.4m round for Guru, a Brazilian retail investment...

-

30 June 2021

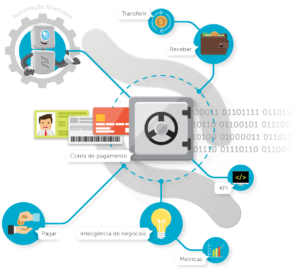

Movile Invests ~USD34m in Brazilian Fintech Platform Zoop (em português)

Movile invested ~USD34m in Zoop, a Brazilian white label fintech platform...

-

29 June 2021

Tiger Global Leads USD22m Series B for Brazilian Corporate Benefits Platform Flash (em português)

Tiger Global led a USD22m Series B for Flash, a Brazilian on-demand...

-

1 June 2021

Endurance Investments Leads BRL210m Series C for Brazilian Identity Authentication Platform idwall (em português)

Chilean VC fund Endurance Investments led a BRL210m Series C for idwall, a...

-

18 May 2021

Minerva Foods and Quartz Lead BRL120m Series B for Brazilian Delivery Platform Shopper (em português)

Brazilian beef exporter Minerva Foods and Quartz led a BRL120m Series B...

-

19 April 2021

Oria Capital and Riverwood Exit Mandic via Sale to Claranet (em português)

Riverwood Capital and Oria Capital partially exited cloud and...

-

22 December 2020

SP Ventures Reaches R$130m Second Close for AgVentures II

SP Ventures announced a R$130m second close for AgVentures II, with a...

-

21 December 2020

Darwin Capital and Angels Invest R$12m in Brazilian Neobank Linker (em português)

Darwin Capital, angels Marcelo Sampaio (Hasdex) and Roberto Nishikawa...

-

20 December 2020

monashees Leads R$30m Round in Brazilian Fintech Nomad (em português)

monashees led a R$30m round in Nomad, a Brazilian fintech offering US...

-

9 December 2020

Valor Capital Group Leads US$2.2m Round in Brazilian Dolado (em português)

Valor Capital Group led a US$2.2m round in Dolado, a Brazilian inventory...

-

25 November 2020

ONEVC Leads US$2.7m Round in Brazilian Agtech TerraMagna

ONEVC led a US$2.7m round in TerraMagna, a Brazilian agtech platform...

-

2 October 2020

Colombia's MUY Tech Rebrands As RobinFood And Raises US$16m Debt Financing

Colombian restaurant management platform MUY Tech rebranded to RobinFood...

-

22 September 2020

Movile Leads R$60m Round in Brazilian Fintech Zoop

Movile led a R$60m round in Zoop, a Brazilian white label fintech platform...

-

14 September 2020

Goldman Sachs Merchant Banking Leads R$120m Series A in Brazilian Fintech iugu

Goldman Sachs Merchant Banking led a R$120m Series A in iugu, a Brazilian...

-

27 August 2020

SP Ventures Reaches US$17.2m First Close on Latin American Agfoodtech Fund

SP Ventures reached a US$17.2m first close for its Latin America-focused...

-

28 July 2020

Quest Venture Partners Makes US$4m Follow-On Investment in Market Intelligence Platform dataPlor

Quest Venture Partners made a US$4m follow-on investment in dataPlor, a...

-

17 July 2020

Canary Invests US$980k in Brazilian Adtech Mobees

Canary invested US$980k in Mobees, a Brazilian adtech startup for...

-

2 July 2020

Aeroespacial Invests R$20m in Kryptus (em português)

Aeroespacial, a Fundo de Investimento em Participações (FIP),...

-

22 June 2020

Global Founders Capital, ONEVC, and Flourish Ventures Invest in Brazilian Fintech Swap

Global Founders Capital, ONEVC, and Flourish Ventures made an undisclosed...

-

29 January 2020

Smart Money Ventures Leads a R$3m Investment in Gama Academy (em português)

Smart Money Ventures led a R$3m investment in Gama Academy, a Brazilian...

-

14 January 2020

ABseed and Order Invest R$10m in Leads2b (em português)

ABseed and Order invested R$10m in Leads2b, a Brazilian client prospecting...

-

13 December 2019

Ânimo Wellness Raises a US$300k Round

Brazilian healthtech Ânimo Wellness raised a US$300k pre-seed round from...

-

5 December 2019

monashees, Valor Capital, and Canary Invest R$38m in Mimic (em português)

monashees, Valor Capital, and Canary invested R$38m in Mimic, a Brazilian...

-

17 September 2019

Vostok Emerging Finance Leads a US$13m Investment in Xerpa (em português)

Vostok Emerging Finance led a US$13m investment in Xerpa, a Brazilian...

-

12 September 2019

ThornTree Capital Partners Leads a R$90m Investment in Liv Up (em português)

ThornTree Capital Partners led a R$90m investment in Liv Up, a Brazilian...

-

24 July 2019

Quest Venture Partners, Magma Partners, and Others Invest in Brazilian Crowdsourcing Dataplor

Dataplor, a Brazilian startup crowdsourcing local retail market...

-

15 May 2019

Monashees Leads US$10.5m Seed Investment in Rental Car Provider Kovi (em português)

Monashees led a US$10.5m seed investment in Kovi ,provider of rental cars...

-

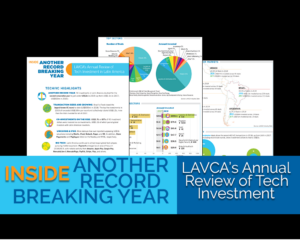

6 May 2019

Inside Another Record Breaking Year: 2019 Review of Tech Investment

Access LAVCA's Annual Review of Tech Investment in Latin America, an...

-

8 March 2019

Smart Money Ventures Invests R$1m in Brazil's Produttivo (em português)

Smart Money Ventures made a R$1m investment in Produttivo, a software...

-

24 January 2019

Valor & Maya Capital Lead R$11.5m Investment in Brazil's Gupy (em português)

Valor Capital led a R$11.5m investment in Gupy, an AI-powered recruiting...

-

26 October 2018

Innova Capital Leads R$22m Series A Round in Bom Pra Crédito (em português)

Innova Capital led a R$22m Series A investment in Bom Pra Crédito, a...

-

18 June 2018

Yield Lab Launches LatAm Accelerator and Invests in 3 Agtech Startups

The Yield Lab has launched a Latin American program based in Buenos Aires...

-

3 May 2018

monashees+, Quona Capital & Propel Venture Partners Lead US$22m Series A in Brazilian Fintech Neon

Propel Ventures Partners, monashees +, and Quona Capital led a US$22m...

-

15 March 2018

Movile Invests in Payment Solutions Startup Zoop (em português)

Movile made a US$18.3m investment in payment solutions startup Zoop, with...

-

22 February 2018

Agfunder Invests in Brazilian Agtech Startup Solinftec

Agfunder made an undisclosed investment in Brazilian agtech...

-

29 November 2017

Movile Invests R$15m in Brazilian Ticketing Platform Sympla (em português)

Movile made a R$15m investment in Sympla, a Brazilian ticketing and event...

-

27 September 2017

Kaszek Ventures Leads Investment in Brazil's Liv Up (em português)

KaszeK Ventures led a R$5m investment in Liv Up, a Brazilian frozen food...

-

18 September 2017

Corporate Venture in Brazil Gains Steam as Giants Amp up Startup Investments

LAVCA’s 2017 Latin American Startup Directory shows that of the 144...

-

22 August 2017

Canary and Yellow Ventures Invest R$1.5m in HRtech Startup Gupy (em português)

Canary and Yellow Ventures invested R$1.5m in Gupy, an HR platform...

-

29 June 2017

Naspers and Innova Capital Invest US$53m in Movile

Naspers and Innova Capital invested a total of US$53m in Brazil-based...

-

31 December 2016

Mesoamerica Invests in Chilean Restaurant Businesses (en español)

(El Financiero) Costa Rican private equity firm Mesoamerica has acquired a...

-

28 September 2016

Why Have Some of Silicon Valley’s Top Investors Started Investing in Latin America?

LAVCA Director of Venture Strategy, Julie Ruvolo, lays out the venture...

-

23 September 2016

Leiturinha Receives R$3m from Movile (em português)

(Exame) Brazilian corporate venture investor Movile has invested R$3m...

-

28 June 2016

Movile Raises US$40m from Naspers and Innova Capital

Movile, Latin America’s leading mobile commerce platform, announced it...

-

13 June 2016

Movile Invests R$13m in Brazilian Ticketing Startup Sympla

(Baguete) Movile announced an investment of R$13m in ticket startup...

-

19 November 2015

Lemann in Negotiates Million Dollar Investment in Movile

(Exame) Brazilian mobile content business, Movile, is in negotiations with...

-

2 July 2015

Ardian-backed Laboratoires Anios Buys Majority Stake in Endoclear

(PEHub) Laboratoires Anios, which is backed by Ardian, has acquired a...

-

17 June 2015

GetNinjas Receives Investment of R$40m led by Tiger Global Management (em português)

(Baguete) Get Ninjas received a round of investment totaling R$40m. The...

-

16 April 2015

Movile Receives R$125m Investment from Naspers (em português)

(Baguete) Movile, Brazil’s leading global mobile commerce platform,...

-

25 November 2014

Movile to Invest R$100m Across Latin America (em português)

(Baguete) Movile, the Brazil-based app development and mobile content...

-

25 September 2014

Movile Invests US$15m in Apontador, The Leading Local Business Reviews and Search Brand in Latin America

(Press Release) Apontador, the industry leading service that helps twenty...

-

8 August 2014

Movile Receives Investment of R$125m (em português)

(E-Commerce) Movile, a mobile solutions provider, received financing of...

-

23 June 2014

Adtrade is Sold to France's ESV Digital (em português)

ESV Digital announced the purchase of Adtrade, a Brazlian online...

-

6 February 2014

Hungry For New Deals, Latin American Wireless Co. Movile Doubles Down On Delivery

(TechCrunch) Brazil’s mobile content developer Movile is on the hunt for...