Search Results

Search results for: "gympass" in All Categories

-

23 August 2023

EQT Growth Leads USD85m Series F for Brazil’s Gympass at USD2.2b Valuation

EQT Growth led a USD85m Series F for Gympass, a Brazil-based B2B gym...

-

29 June 2021

Brazilian Corporate Wellness Platform Gympass Raises USD220m Series E

Gympass, a Brazilian B2B gym membership platform with global operations,...

-

12 June 2019

SoftBank Invests US$300m in Gympass

Gympass, a Brazilian B2B gym membership platform with global operations,...

-

25 January 2019

SoftBank to Lead US$190m+ Investment in Brazil's Gympass (em português)

#UNICORNS SoftBank will lead a US$190m (and up to US$500m) investment in...

-

5 December 2017

General Atlantic Invests in Brazil's Gympass (em português)

General Atlantic has made an undisclosed investment in Brazilian startup...

-

5 October 2021

Mercado Libre and KASZEK SPAC Raises USD287m In Public Listing

MELI Kaszek Pioneer Corp (MEKA), a SPAC formed by Mercado Libre and...

-

7 July 2021

MFO Turim Leads ~USD2.4m Round for Brazilian Retail Investment Platform Guru (em português)

MFO Turim led a ~USD2.4m round for Guru, a Brazilian retail investment...

-

20 April 2021

QED Investors Leads UDD15m Series B for Brazilian Payment Services Provider Hash

QED Investors led a USD15m Series B for Hash, a Brazilian payment services...

-

15 January 2021

KaszeK Ventures Leads R$20m Series A in Brazilian Customer Service Platform OmniChat

KaszeK Ventures led a R$20m Series A in OmniChat, a Brazilian chat-based...

-

8 December 2020

Volpe Capital Reaches US$50m First Close for Early Stage Latin America Fund (em português)

Volpe Capital, a VC fund founded by former SoftBank Managing Partner Andre...

-

20 October 2020

Valor Capital and monashees Lead R$86m Series A in Brazilian Healthtech Sami

Valor Capital and monashees led a R$86m Series A in Sami, a Brazilian...

-

30 September 2020

Global Founders Capital, Ribbit Capital, and MAYA Capital Invest US$3.3m in Proptech Alude

Global Founders Capital, Ribbit Capital, MAYA Capital, and Y Combinator...

-

21 September 2020

General Atlantic and SoftBank Lead US$108m Series B in Acesso Digital

General Atlantic and SoftBank’s Latin America Fund led a US$108m Series...

-

29 July 2020

Redpoint eventures Leads US$11m Series B in Magnetis

Redpoint eventures led a US$11m Series B in Magnetis, a Brazilian personal...

-

22 July 2020

Valor Capital Invests US$4m in Solar Energy Financing Platform Solfácil

Valor Capital invested US$4m in Solfácil, a Brazilian solar energy...

-

11 July 2020

QED Investors, KaszeK Ventures, and Others Invest US$22.5m Series B in Digital Brokerage Warren

QED Investors led a US$22.5m Series B in Brazilian digital brokerage...

-

1 July 2020

Canary, KaszeK Ventures, and MAYA Capital Invest US$16m in Alice

Canary, KaszeK Ventures, and MAYA Capital invested US$16m in Alice, a...

-

17 June 2020

Redpoint eventures Leads a US$2.3m Round in Customer Intelligence Platform Arena

Redpoint eventures led a US$2.3m seed round in San Francisco-based Arena,...

-

3 June 2020

Valor Capital and Redpoint eventures Lead a US$47m Series B in Tembici

Tembici, a Brazilian micro-mobility platform focused on bikes, raised a...

-

1 June 2020

SoftBank Latin America Fund Leads a US$22m Series B in Cortex

Cortex, a Brazilian SaaS marketing and sales growth platform, raised a...

-

20 February 2020

Redpoint Eventures and DNA Capital Invest US$4.5m in Memed

Redpoint eventures and DNA Capital, the corporate venture arm of DASA, led...

-

7 February 2020

Redpoint Eventures Invests US$4m in Kzas

Redpoint eventures led a US$4m seed investment in Kzas, a Brazilian...

-

5 December 2019

monashees, Valor Capital, and Canary Invest R$38m in Mimic (em português)

monashees, Valor Capital, and Canary invested R$38m in Mimic, a Brazilian...

-

29 November 2019

Redpoint eventures Invests R$50m in Housi (em português)

Redpoint eventures made a R$50m investment in Housi, a Brazilian property...

-

13 November 2019

Redpoint eventures Leads a US$1.12m Investment in Vittude

Redpoint eventures led a US$1.12m seed investment in Vittude, a Brazilian...

-

17 October 2019

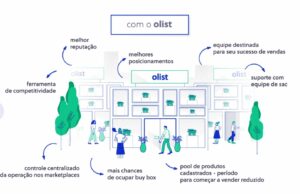

SoftBank Leads a R$190m Investment in Olist (em português)

SoftBank led a R$190m investment in Olist, a Brazilian e-commerce...

-

11 October 2019

Fifth Wall Ventures Leads a Series A US$10m Investment in Cobli (em português)

Fifth Wall Ventures led a US$10m investment in Cobli, a Brazilian...

-

4 October 2019

KaszeK Ventures Leads a R$7m Investment in Theia, founded by Flávia Deutsch & Paula Crespi (em português)

KaszeK Ventures led a R$7m investment in Theia, a Brazilian family support...

-

29 August 2019

KaszeK Ventures Raises US$600m Across Two New Funds

KaszeK Ventures raised US$600m across two new funds, including US$375m for...

-

15 May 2019

Monashees Leads US$10.5m Seed Investment in Rental Car Provider Kovi (em português)

Monashees led a US$10.5m seed investment in Kovi ,provider of rental cars...

-

9 May 2019

KaszeK Ventures, Redpoint e.ventures and QED Investors Invest R$16m Series A in Xerpa (em português)

KaszeK Ventures, Redpoint eventures and QED Investors made a R$16m Series...

-

26 March 2019

QED & Invus Co-Lead US$22.6m Investment in Brazil's Escale

QED Investors and Invus Opportunities co-led a US$22.6m investment in...

-

7 March 2019

Softbank Announces US$5b Fund for Latin American Tech

SoftBank announced an initial US$2b commitment on a new SoftBank...

-

31 January 2019

SoftBank Plans to Launch Latam Fund with Potential to Reach US$1b+

SoftBank is preparing a Latin American fund that “could reach several...

-

26 November 2018

General Atlantic Invests R$250m in Brazilian Apartment Rental Platform QuintoAndar

General Atlantic invested R$250m in Brazilian apartment rental platform...

-

1 October 2018

Domo Invest Leads R$4m Investment in Brazilian Car-Sharing Platform Turbi (em português)

Domo Invest led a R$4m investment in Turbi, a Brazilian car-sharing...

-

11 January 2018

State of the Industry: 2017 VC Deal Activity & Highlights

The entrance of major global investors into a string of recent early and...

-

15 June 2017

DGF Invests in Brazilian Edtech Startup Mosyle

DGF Investimentos made an undisclosed investment in Brazilian edtech...

-

31 January 2017

Former Buscapé Executives Launch Venture Fund Domo Invest (em português)

Two former Buscapé executives, Ridrigo Borges and Guga Stocco, have...