Search Results

Search results for: "IGNIA" in All Categories

-

19 January 2021

Nexxus and IGNIA Announce Alliance (en español)

Mexican PE Nexxus Capital announced an undisclosed commitment in...

-

6 December 2019

IGNIA, LW Investment Management, and Angels Invest US$2.5m in Fondeadora

IGNIA Partners, LW Investment Management, and angels made a US$2.5m...

-

9 May 2019

Signia Venture Partners Leads US$2.5m Round in Colombia’s Picap

Signia Venture Partners led a US$2.5m seed round in Colombia’s Picap to...

-

9 April 2019

IGNIA Partners Invests in Mexico's Takeoff

IGNIA Partners made an undisclosed investment in Takeoff, an ecommerce...

-

3 April 2019

Adobe Capital & IGNIA to Exit Mexico's Provive

Adobe Capital and IGNIA announced their divestment from Provive, a Mexican...

-

25 March 2019

IGNIA Partners Backed GoTrendier Merges with Chicfy

GoTrendier and Chicfy merged to create the leading clothing resale...

-

5 March 2019

IGNIA Invests US$1.5m in Mexican Fintech Fondeadora

IGNIA invested US$1.5m in Fondeadora, a Mexican open banking platform....

-

13 February 2019

General Catalyst, IGNIA, & Others Invest US$40m in Fintech Platform Rapyd

General Catalyst and payments unicorn Stripe led a US$40m Series B in...

-

29 January 2019

IGNIA Leads US$3.5m Investment in Mexico's GoTrendier

IGNIA, Ataria Ventures, and Banco Sabadell led a US$3.5m investment in...

-

4 December 2018

IGNIA & Dalus Capital Lead US$6.5m Investment in Mexico's UnDosTres

IGNIA and Dalus Capital led a US$6.5m investment in online payments...

-

26 September 2018

IGNIA Leads Undisclosed Investment in Mexican EdTech Kinedu

IGNIA led an undisclosed investment in Kinedu, a Mexican edtech platform...

-

19 June 2018

IGNIA Leads Undisclosed Investment in Mexican Digital Fashion Marketplace Trendier

IGNIA, Antai venture Builder, Pedralbes Partners, Bonsai Venture Capital...

-

22 May 2018

IGNIA Makes Undisclosed Investment in Mexican IT Startup Virket

IGNIA made an undisclosed investment in Virket, a Mexican provider of...

-

23 March 2018

IGNIA Exits Mexican Tuna Producer Grupo Procesa

IGNIA has sold its participation in Mexican sustainable tuna producer...

-

15 March 2018

IGNIA & ALLVP Invest in Fintech Startup Visor

Mexican venture capital fund IGNIA lead a new undisclosed investment round...

-

20 February 2018

IGNIA, Kaszek, Monashees, & Global Founders Capital Invest in Brazil's Doghero

IGNIA, Kaszek Ventures, Monashees and Global Founders Capital have...

-

9 February 2018

IGNIA Increases Investment in Mexican Startup AirTM (en español)

Mexican venture capital firm IGNIA has made a follow on investment in...

-

21 January 2018

IGNIA & Global Founders Lead US$2.5m Investment in Brazilian Startup DogHero (em português)

IGNIA Partners and Global Founders Capital led a US$2.5m investment in...

-

11 January 2018

Mexican Venture Capital Firm IGNIA Announces New Partners

IGNIA welcomes new partners Christine Kenna (formerly a Principal) and...

-

24 October 2017

IGNIA, Capital Invent & Avalancha Make Series A Investment in Bind ERP

IGNIA, Capital Invent, and Avalancha Ventures made an undisclosed...

-

20 September 2017

Tienda Nube Tackles E-commerce with US$7m Series B from Elevar Equity, IGNIA, KaszeK Ventures

Tienda Nube provides over 16,000 merchants an omnichannel e-commerce...

-

15 September 2017

HSBC México & IGNIA Partner to Launch Latin American Fintech Startupbootcamp (en español)

HSBC México and IGNIA have partnered to launch Startupbootcamp Fintech to...

-

6 September 2017

Elevar Equity and IGNIA Make US$7m Investment in Tienda Nube/Nuvem Shop

Elevar Equity led a US$7m Series B in Tienda Nube (known as Nuvem Shop in...

-

22 August 2017

IGNIA, Angel Ventures, ON Ventures & GC Capital Invest in Rocket.la's Bridge Funding Round

IGNIA, Angel Ventures Mexico, ON Ventures, and GC Capital participated in...

-

17 August 2017

IGNIA Makes Five Investments in 2017 (en español)

Mexican VC IGNIA invested in five startups this year: Apli, AirTM,...

-

17 July 2017

IGNIA Invests in Colombian e-commerce Platform LentesPlus

IGNIA made an undisclosed investment in LentesPlus, with participation...

-

13 July 2017

IGNIA Invests in Latin American Lending Network Afluenta

IGNIA made an undisclosed investment in Afluenta, a peer to peer lending...

-

28 June 2017

IGNIA Invests in Mexico's KarmaPulse

Mexican venture capital firm IGNIA made an undisclosed investment in...

-

7 February 2017

Alvaro Rodriguez Arregui, Co-Founder & Managing Partner, IGNIA

LAVCA spoke with Alvaro Rodriguez Arregui, Co-Founder & Managing...

-

31 January 2017

Ignia Invests in Mexican Fintech Startup AirTM

Ignia, a Mexican venture capital firm, made an undisclosed investment in...

-

16 January 2017

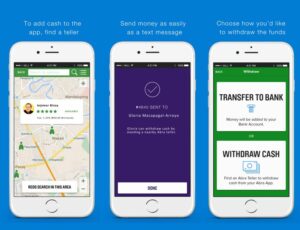

IGNIA Invests in US-Based Fintech Company Abra

Mexican Venture Capital fund IGNIA made an undisclosed investment in Abra,...

-

25 December 2016

IGNIA Invests in Three Mexican Startups in 2016 (en español)

(El Economista) Venture Capital fund IGNIA concluded its third investment...

-

8 December 2016

Ignia, KDWC Ventures and Jump Capital Make Series B Investment in Pangea

(Press Release) IGNIA has made a Series B investment in Pangea Money...

-

23 November 2016

IGNIA Leads Investment Round in Mexico's Sr. Pago (en español)

(Press Release) IGNIA has invested an undisclosed amount in Mexico-based...

-

3 November 2016

IGNIA and Gerbera Capital Invest in Underdog Media (en español)

(Press Release) Underdog Media, a Mexican tech company and first digital...

-

15 April 2016

Ignia Invests in Aqua Sustenable Tres (en español)

(Grupo BMV) Ignia has made a MXN$6,334,822 (US$362,821) convertible debt...

-

10 November 2015

IGNIA Raises US$90m for Mexican investments in First Close of Fund II

(Alt Assets) Mexican social enterprise-focused venture capital firm IGNIA...

-

3 November 2015

Ignia Issues New CKD (en español)

(El Economista) Venture Capital fund, Ignia, has issued a new CKD vehicle...

-

25 October 2015

Ignia Targets US$100m for Second Fund

(El Economista) 8 years after raising its first investment fund for...

-

27 February 2015

Ignia Aims to Raise MXN$2.6b through a CKD (en español)

(Ventura MX) Investment firm Ignia is planning to raise MXN$2.6b from the...

-

29 January 2013

IGNIA leads investment of MXN$ 104.4 million in Procesa Chiapas

IGNIA led investment in Endeavor Entrepreneur Procesa Chiapas (Endeavor...

-

22 November 2011

Leon Kraig Joins IGNIA as General Partner and Managing Director

(IGNIA) November 22, 2011– IGNIA Fund I, LP, the first and largest...

-

8 November 2011

IGNIA Fund I Invests MXN$44M in Provive

(IGNIA) November 8, 2011– IGNIA Fund I, LP, the first impact investing...

-

7 September 2011

Omidyar Network and IGNIA Lead $13.75 Million Series B Round in Finestrella

(IGNIA) September 7, 2011 – Omidyar Network and IGNIA announced they...

-

26 May 2011

IGNIA Fund I Invests US$2.4M in Mexico-based Aqua

(IGNIA) May 26, 2011 – IGNIA Fund I, LP, the first impact investing fund...

-

14 October 2010

IGNIA Fund I Invests $3.1M in Telecomm Company Barafón

(IGNIA) October 13, 2010 – IGNIA Fund I, LP, the first impact investing...

-

22 June 2010

IGNIA Completes Closing of Fund I at US$102 Million

(IGNIA) June 22, 2010 – IGNIA Fund I, LP Latin America’s first and...

-

18 June 2010

IGNIA and Axial to Jointly Invest in Brazil

(IGNIA) June 18, 2010 – IGNIA Fund I, L.P. Latin America’s first...

-

18 May 2010

IGNIA leads US$6.5 million investment in Chiapas Farms

(Monterrey, Mexico) May 18, 2010 – IGNIA Fund I, LP, the first impact...

-

9 June 2023

PayPal Ventures Leads USD14m Series A for Uruguay’s nocnoc

PayPal Ventures led a USD14m Series A for nocnoc, an Uruguay-based...

-

22 November 2022

Mexico’s GoTrendier Raises ~USD15m Series B Led by IDB Invest, Creas Impacto and IDC Ventures

(IDB Invest | Flow Partners) GoTrendier, a Mexico-based second-hand...

-

4 August 2022

Portage Leads USD6.5m Seed Round for Mexico’s Kontempo

(TechCrunch) Portage led a USD6.5m seed round for Kontempo, a Mexico-based...

-

17 August 2021

Tiger Global and Insight Partners Lead USD500m Round for Ecommerce Platform Tiendanube

Tiger Global and Insight Partners led a USD500m round for...

-

20 May 2021

G2VP Leads USD43m Series C for Latin America Farmer Financing Platform ProducePay

G2VP led a USD43m Series C for ProducePay, a US-based financing platform...

-

13 October 2020

KaszeK and Qualcomm Lead US$30m Series C in Argentina’s E-Commerce Platform Nuvemshop

KaszeK Ventures and Qualcomm Ventures led a US$30m Series C for Nuvemshop...

-

27 August 2020

Gradient Ventures Leads US$14m Series A in Mexican Challenger Bank Fondeadora

Gradient Ventures led a US$14m Series A in Fondeadora, a Mexican open...

-

19 December 2019

BlackRock Lists a Cerpi for US$68.8m (en español)

BlackRock listed a Cerpi on the Mexican BMV to raise US$68.8m. The Cerpi...

-

19 March 2019

Rover Leads US$7m Investment in Brazilian Pet-hosting Startup DogHero

Seattle-based petsitting marketplace Rover led a US$7m investment in...

-

29 November 2018

New York VC Palm Drive Capital Leads US$5m Series A in Online Retailer LentesPlus

New York VC Palm Drive Capital led a US$5m Series A in LentesPlus, an...

-

11 October 2018

Fortem Capital Completes MXN$5b Raise on Mexico's Biva (en español)

Mexican real estate fund manager Fortem Capital has placed a CKD vehicle...

-

21 September 2018

Fortem Capital Raises MXN$5,000m via BIVA Instead of BMV (en español)

Fortem Capital, a subsidiary of the IPB Group real estate company, seeks...

-

29 August 2018

BlueYard Capital Leads US$7m Series A in Financial Services Startup AirTM

BlueYard Capital led a US$7m Series A investment round in financial...

-

16 May 2018

Angel Ventures Fund Prepares Debut CKD on Mexico's BMV (en español)

Angel Ventures seeks to raise MXN$1bn from Mexican Afores for its debut...

-

20 March 2018

Finnovista Welcomes 5 Growth Stage Startups to Startupbootcamp Program (en español)

Startupbootcamp Scale FinTech Mexico City, a program for growth stage...

-

10 August 2017

ALLVP Leads US$1.5m Follow-on Investment in Apli

ALLVP led a US$1.5m follow-on investment in Apli, a Mexican startup...

-

3 April 2017

BlueOrange Launches Impact Fund to Invest US$1b in Latin America and the Caribbean

BlueOrange Capital launched an impact fund that plans to mobilize US$1b...

-

30 March 2017

The Abraaj Group to Invest US$1.5b in Mexico and Latin America (en español)

Dubai-based The Abraaj Group announced it plans to invest up to US$1.5b in...

-

9 July 2013

Jaguar Ventures Out to Raise US$60 Million to Fund Startups in Mexico

(The Wall Street Journal) There’s a new player in Mexico’s venture...

-

29 October 2012

Brazil’s Vox Capital Impact Investing Fund gets $4M Equity Investment

(MIF/FOMIN) October 29, 2012 – The Multilateral Investment Fund...

-

10 May 2012

Gerbera Capital and Gava Capital Invest in Mexican Real Estate Project (en español)

(Gerbera Capital) May 10, 2012 – Gava Capital, a Mexican-based real...

-

10 May 2010

Finestrella Raises $7 Million

May 10, 2010 – IGNIA Fund I, LP, the first impact investing fund in...